Please use a PC Browser to access Register-Tadawul

What Recent Share Weakness Means for Restaurant Brands International’s Long-Term Prospects in 2025

Restaurant Brands International Inc QSR | 70.64 | -0.49% |

If you have been eyeing Restaurant Brands International and wondering whether now is the moment to make a move, you are not alone. It is a stock that always seems to inspire plenty of debate, especially lately, with its share price dipping a modest 0.3% over the last week and down 3.6% for the past month. Year-to-date, shares have slipped 4.0%, and looking back, the one-year return is at -5.7%. However, if you look further, over three years the stock has managed an impressive 17.4% return, and over five years, 32.5%. That kind of long-term resilience has certainly caught the attention of value-focused investors.

What is sparking these moves? Much of the recent pressure seems to reflect broader market jitters rather than anything specific to Restaurant Brands International. There have been shifts in investor appetite for consumer-facing stocks, and restaurants in particular, as markets digest higher interest rates and global economic uncertainty. None of this seems to have dented the company's underlying fundamentals, which continue to look attractive for value-seeking investors.

In fact, by the numbers, Restaurant Brands International is currently undervalued on every metric we track, earning a perfect valuation score of 6 out of 6. This alone makes it stand out in a competitive fast-food sector. But what does that score really mean, and how does it compare to other approaches to valuation? In the next section, we will break down the main ways analysts evaluate a company's value and introduce an even more effective way to gauge whether the stock deserves a place in your portfolio.

Why Restaurant Brands International is lagging behind its peersApproach 1: Restaurant Brands International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its expected future cash flows and then discounting them back to today's dollar value. For Restaurant Brands International, recent financials show Free Cash Flow of $1.26 Billion for the last twelve months, marked as a healthy starting point. Looking ahead, analysts project the company will grow its Free Cash Flow over the next decade, with figures expected to reach just over $3.9 Billion by 2035, according to Simply Wall St's estimates.

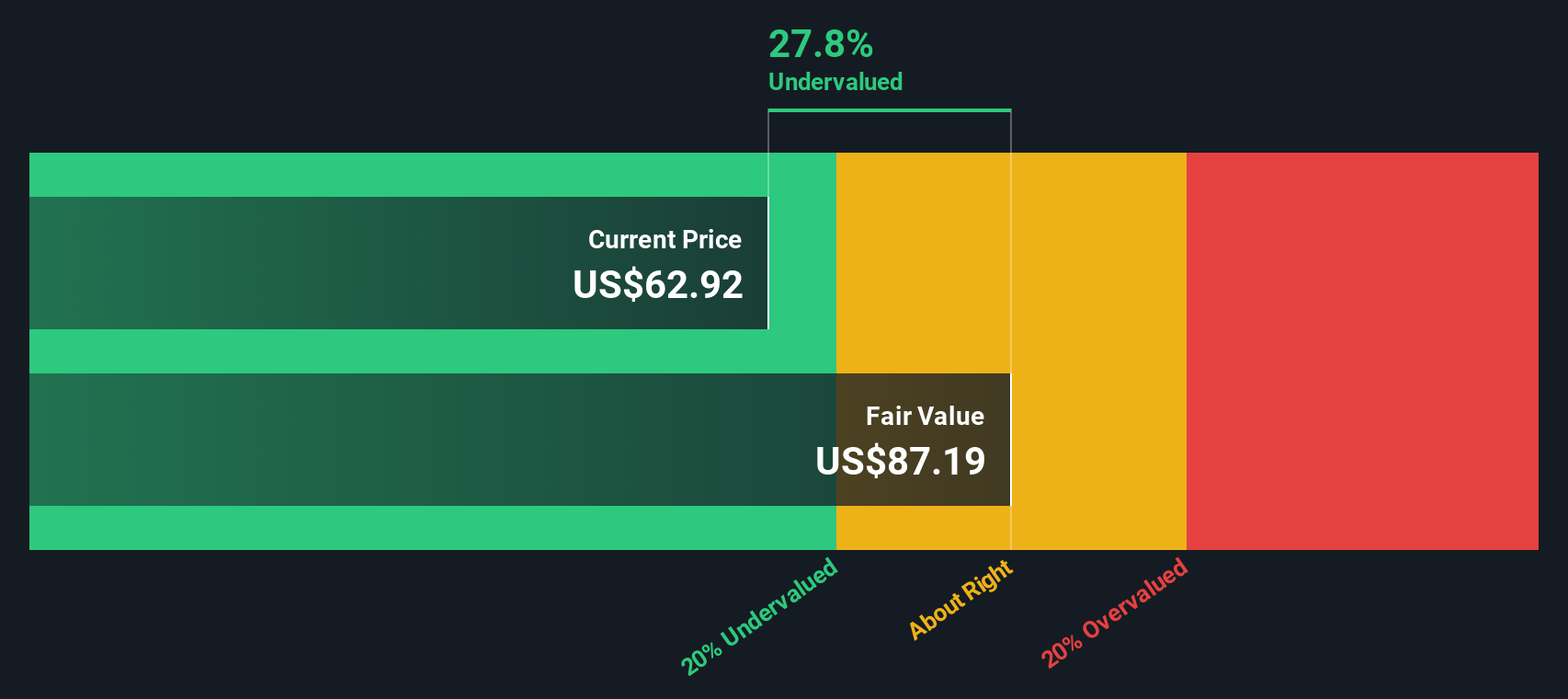

These cash flow projections rely on a combination of direct analyst forecasts for the next five years and reasonable extrapolations for the years that follow. By compiling these projections and discounting them using the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic share value of $87.19.

Compared to the current trading price, this valuation implies the stock is 27.8% undervalued. For investors, this suggests Restaurant Brands International is trading at a significant discount to its forecasted cash flow generation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Restaurant Brands International.

Approach 2: Restaurant Brands International Price vs Earnings

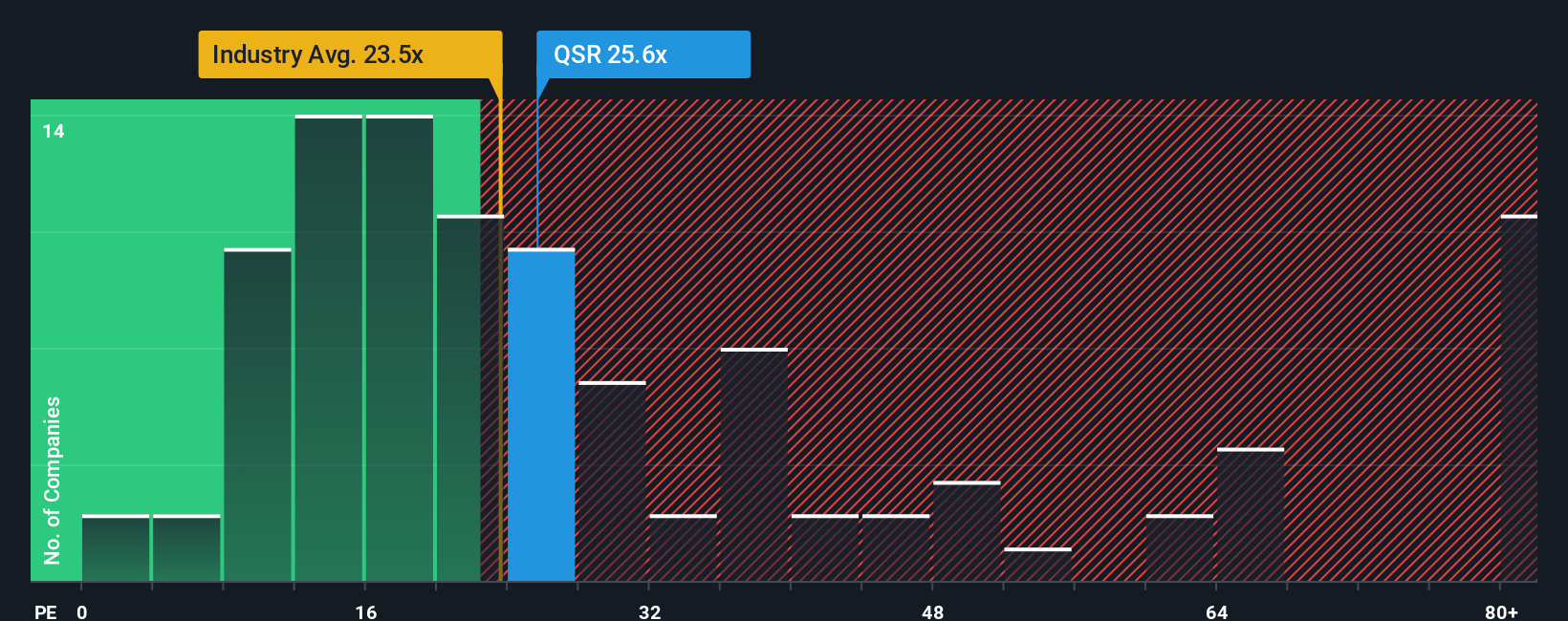

For profitable companies like Restaurant Brands International, the Price-to-Earnings (PE) ratio is a widely accepted and insightful way to value shares. This metric compares a company's current share price to its earnings per share, giving investors a sense of what they are paying for each dollar of profit. Typically, higher growth expectations and lower risk justify a higher PE, while slower growth or higher risk might result in a "normal" or "fair" PE being lower.

Restaurant Brands International currently trades at a PE ratio of 23.9x. To put this in context, the average PE for the hospitality industry is 24.0x, and its direct peer group trades even higher at 25.9x. These benchmarks suggest that Restaurant Brands International is priced mostly in line with the broader sector and peers.

However, instead of just comparing with peers or broad industry averages, Simply Wall St also calculates a proprietary “Fair Ratio.” This Fair Ratio, calculated at 30.0x for Restaurant Brands International, adjusts for specifics like the company's actual earnings growth, profit margins, size, and risk level. This individualized approach often provides a more accurate reflection of what the company’s multiple should be, recognizing its unique position and prospects.

With a current PE of 23.9x and a Fair Ratio of 30.0x, Restaurant Brands International is trading below what would be expected for a company of its quality, growth, and risk profile. This comparison suggests that the stock is undervalued on a price-to-earnings basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Restaurant Brands International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are clear, approachable stories you build around a company, connecting your beliefs about its key drivers, future performance, and risks to an actual financial forecast and resulting fair value.

With Narratives, investors can quickly lay out their expectations for factors like revenue growth, future margins, and market challenges, then see how those assumptions impact fair value. You can do this all on the Simply Wall St platform's Community page, used by millions of investors worldwide. Narratives make it much easier to decide when to buy or sell because as you compare your calculated Fair Value (based on your story and numbers) to the current share price, your own perspective moves from abstract belief to actionable insight.

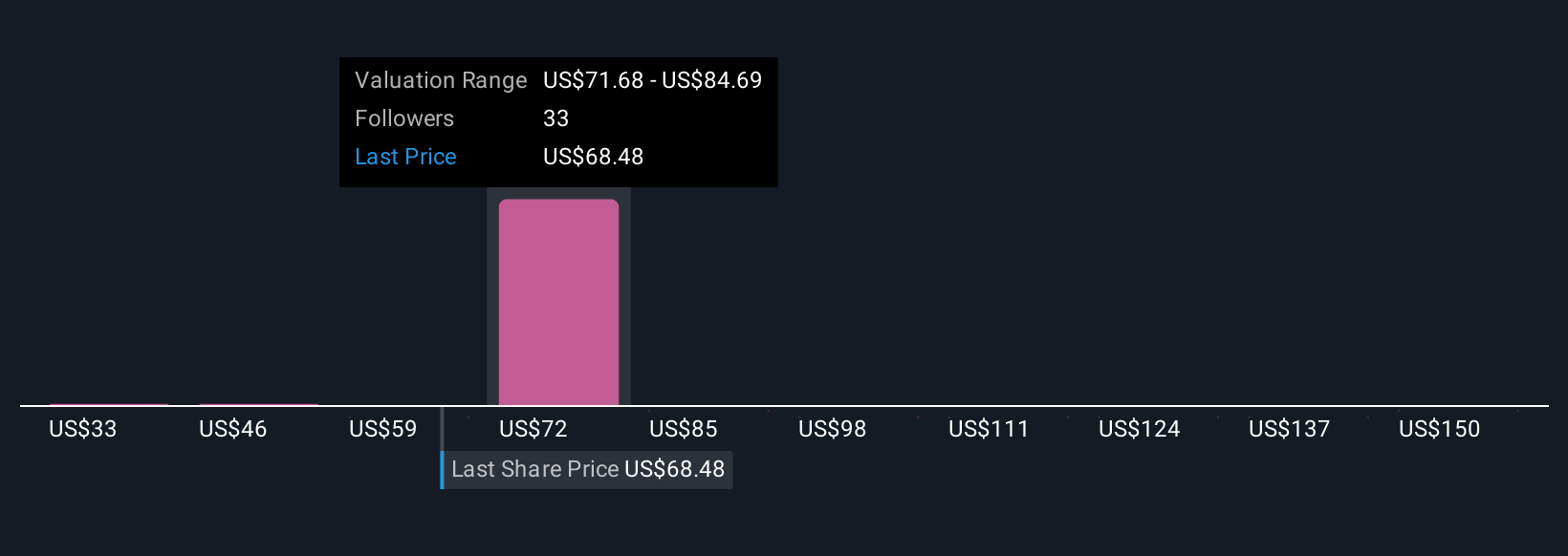

A key advantage is that Narratives update dynamically as new information, such as earnings releases or news, becomes available, helping you react in real time. For example, among users on Simply Wall St, some see Restaurant Brands International worth as much as $93.00 per share based on international expansion and digital growth, while others set their value closer to $60.00, citing concerns over cost inflation and competitive pressures. Narratives offer a simple yet powerful way to connect your unique outlook to a concrete investment decision.

Do you think there's more to the story for Restaurant Brands International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.