Please use a PC Browser to access Register-Tadawul

What the Recent 11% Surge Means for Iovance Biotherapeutics Stock in 2025

Iovance Biotherapeutics Inc IOVA | 2.20 2.20 | -2.22% 0.00% Pre |

Wondering what to do with Iovance Biotherapeutics stock right now? You are definitely not alone. Anyone watching the biotech sector has seen Iovance’s share price swing from hope to heartbreak a few times over the years. If you are tracking the ticker, you probably have questions about whether the worst is over or if there is hidden value waiting to be unlocked.

Let us set the stage. This year, shares have tumbled by a staggering 70.0% year-to-date and are down more than 77% over the past twelve months. The decline stretches even further back, with a painful 92.5% drop over five years. But despite this rough ride, the past week delivered a jolt of optimism, as the stock jumped 10.9%. That quick gain, even after such a brutal long-term slide, hints that investors are starting to see potential catalysts ahead or are rethinking the risk-reward balance. Shifts in FDA regulatory comments and renewed discussions around cell therapy breakthroughs have contributed to this spark, sending some traders and analysts scrambling to reevaluate expectations.

That leaves us with a pressing question. Is Iovance just a high-risk speculation, or has the market overlooked true value? According to our valuation checklist, the company scores a 5 out of 6 on undervaluation criteria, which is a rare green flag among biotech names punished by uncertainty.

Before jumping to any conclusions, let’s unpack those valuation methods and see exactly where Iovance stands. If you are searching for a smarter way to size up value, stick around for the approach we think belongs at the top of your toolbox.

Approach 1: Iovance Biotherapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. Essentially, this approach tries to answer what Iovance Biotherapeutics is worth if you account for all the money it could generate in the future, adjusted for risk and time.

According to the latest numbers, Iovance's current Free Cash Flow (FCF) sits at negative $348.7 million, underscoring the company's ongoing investment phase. Analyst forecasts suggest a dramatic turnaround in the next few years, with FCF expected to flip positive and reach $296 million by 2029. Forecasts then show this figure rising even higher as projections extend further. While estimates exist for the first five years, the projections from 2030 onward are extrapolated and provide a roadmap of robust growth into the next decade.

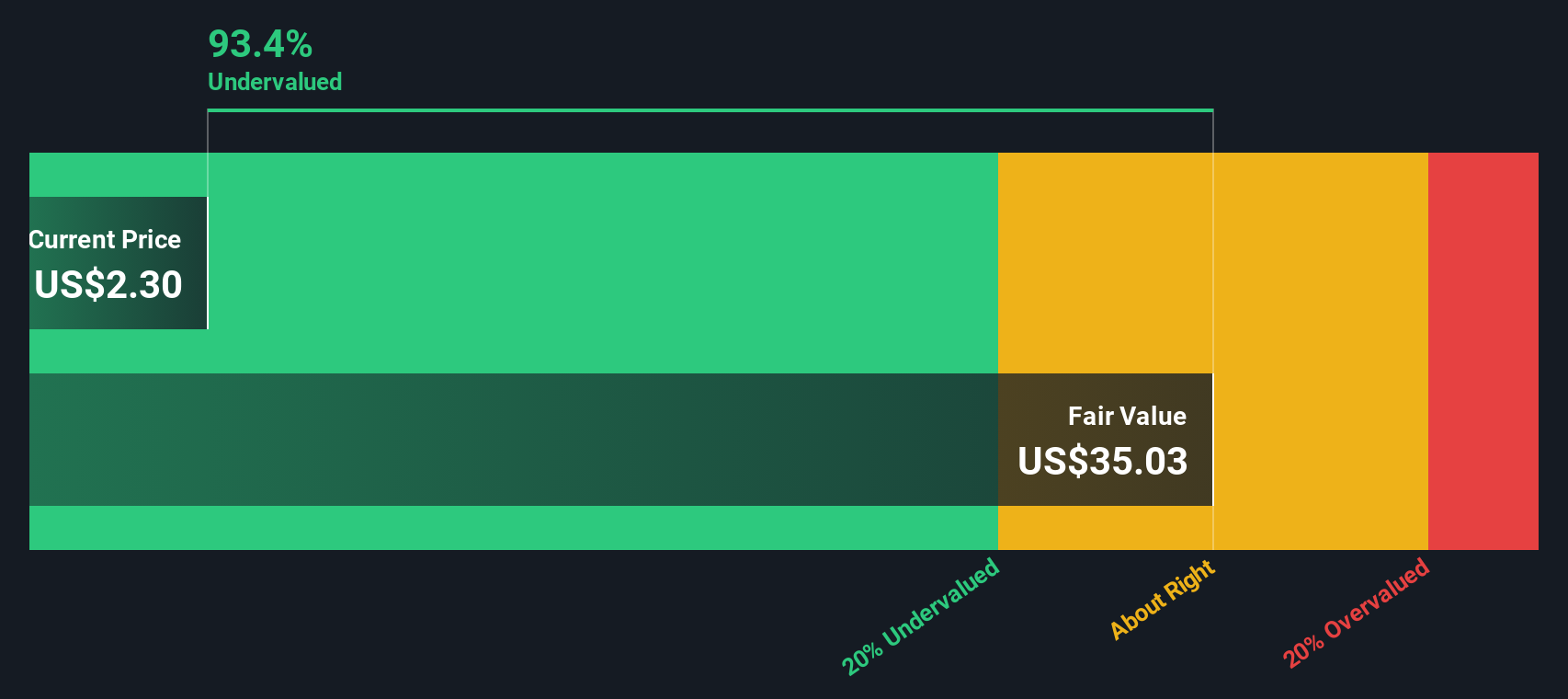

By aggregating these annual cash flows and discounting them, the DCF model calculates a fair value estimate for Iovance at $39.00 per share. This is 94% above the current market price, implying the stock may be significantly undervalued based on present expectations for future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Iovance Biotherapeutics is undervalued by 94.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

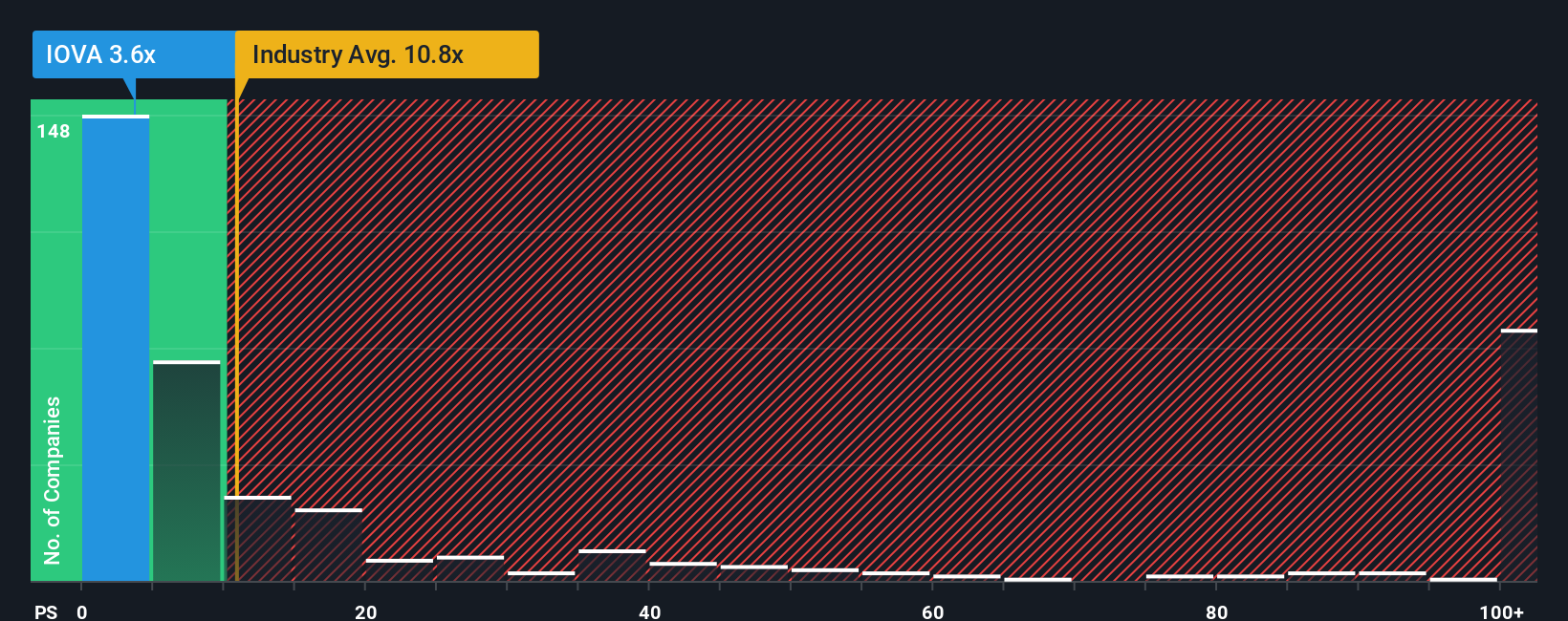

Approach 2: Iovance Biotherapeutics Price vs Sales

The price-to-sales (P/S) ratio is commonly used to value companies like Iovance Biotherapeutics, which are still investing heavily for future profitability and may not yet have positive earnings. This multiple is especially suitable for emerging biotechs, where revenue generation is an important milestone and profitability can be years away.

Growth expectations and risk both play a big role in what qualifies as a “fair” P/S ratio. If investors expect rapid revenue growth or breakthrough developments, they might accept a higher ratio. Conversely, a higher perceived risk typically means a lower acceptable multiple.

Currently, Iovance trades at a P/S ratio of 3.5x. This is notably below both the industry average of 10.5x and the peer average of 7.2x. At first glance, this suggests the company is valued much more conservatively than most of its biotech peers.

However, Simply Wall St’s proprietary Fair Ratio offers more context. Unlike a simple industry or peer comparison, the Fair Ratio (4.1x) incorporates Iovance’s unique growth potential, risk factors, profit margin profile, industry context, and market cap. This tailored approach gives a more relevant benchmark for fair value.

With Iovance’s current P/S of 3.5x sitting just below the Fair Ratio of 4.1x, the stock appears to be undervalued based on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

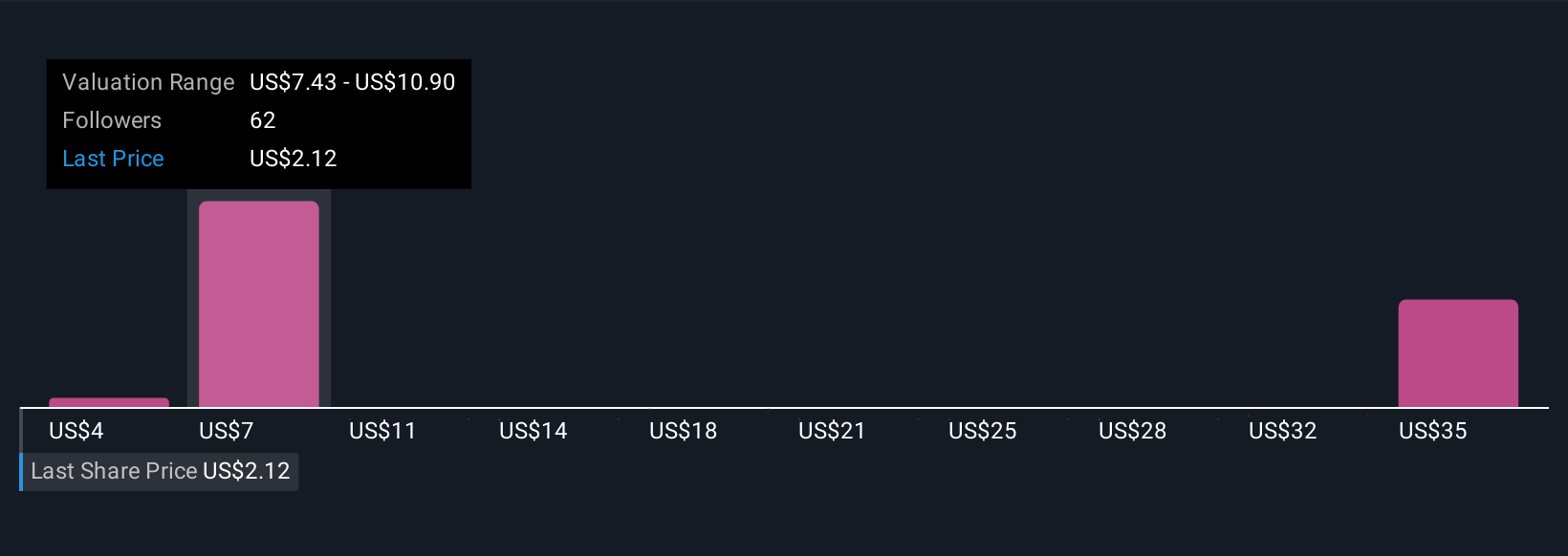

Upgrade Your Decision Making: Choose your Iovance Biotherapeutics Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple but powerful tool that let you tell the story behind a stock such as Iovance Biotherapeutics. Instead of just focusing on numbers, a Narrative combines your personal perspective—why a company will succeed or struggle—with your expectations for future revenue, profits, and margins to create a clear financial forecast and a fair value estimate. This approach links the company's big-picture story to what you think it is worth, helping you see if the current price reflects your outlook.

Narratives are designed to be accessible to all investors and are available right now on Simply Wall St’s Community page, used by millions to share and update their investment views. Narratives make it easy to adjust your estimate as new news or earnings are released, so your outlook stays current. By comparing your Narrative’s fair value to today’s price, you can quickly decide whether to buy, hold, or sell based on your own view, not just analyst targets.

For example, some investors may have a bullish Iovance view, believing global approvals and new therapies will unlock large revenue, yielding a fair value above $20. Others may see regulatory risks and commercial adoption challenges, putting fair value closer to $1. Narratives give both types of investors a way to clearly express and act on their conviction.

Do you think there's more to the story for Iovance Biotherapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.