Please use a PC Browser to access Register-Tadawul

What Would Happen If Trump Fired Powell? Markets Conducted an "Earthquake Drill" Last Night

Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund ETF UUP | 27.96 | +0.22% |

DB US Dollar Index Bearish Powershares UDN | 18.76 | -0.16% |

S&P 500 index SPX | 6721.43 | -1.16% |

NASDAQ IXIC | 22693.32 | -1.81% |

Dow Jones Industrial Average DJI | 47885.97 | -0.47% |

① On Wednesday, financial markets just conducted a "simulation exercise" ——simulating what would happen if President Trump attempted to fire Federal Reserve Chair Jerome Powell.

② While it only triggered a brief storm, the outcome was clearly far from optimistic...

On Wednesday, financial markets just conducted a "simulation exercise" – simulating what would happen if President Trump attempted to fire Federal Reserve Chair Jerome Powell. While it only triggered a brief storm, the outcome was clearly far from optimistic...

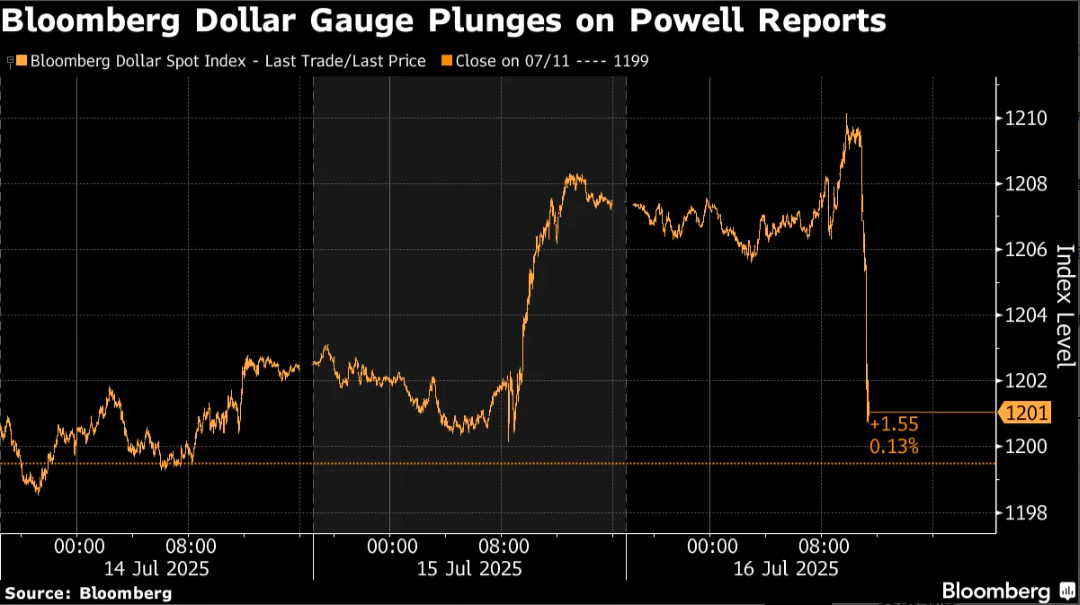

As news broke during the New York session that Trump had discussed "firing Powell" in a closed-door meeting with congressional Republicans, the market reaction was almost uniformly negative. Stocks, the US dollar, and long-term US Treasury prices all fell rapidly. The ICE US Dollar Index (DXY)(Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund ETF(UUP.US) )(DB US Dollar Index Bearish Powershares(UDN.US) ), which measures the dollar's strength against a basket of six major currencies, dropped as much as 0.8%, while the S&P 500 index (S&P 500 index(SPX.US) ) briefly plunged about 0.6% intraday.

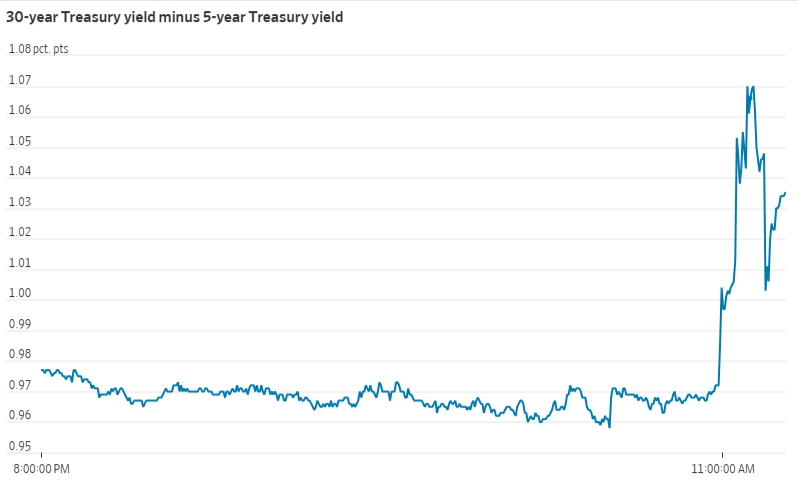

The movements in the bond market were perhaps the most telling. Expectations that Trump's chosen successor to Powell might swiftly cut rates upon taking office drove short-term Treasury yields down sharply intraday. However, simultaneous concerns about runaway inflation, threats to the Fed's independence, and risks to US financial system stability triggered a rapid sell-off in long-term Treasuries. Yields on 10-year and 30-year Treasuries surged.

As a result, the Treasury yield curve steepened rapidly during the session – the gap between the 30-year bond yield and the 5-year bond yield briefly widened to 103 basis points, up from 97 basis points before the first reports of Powell's potential firing emerged.

For many investors, the only relief overnight was that the report of Trump "firing Powell" was quickly clarified by Trump himself. Furthermore, some industry insiders may still cling to the "wishful thinking" that the actual possibility of Trump taking action to remove the Fed Chair remains very low, given the questionable legality of firing a Fed Chair at the legal level, coupled with the likelihood that officials like Treasury Secretary Besant would recognize the market's rejection of such a move.

Trump later explained that he had no intention of firing Powell and had only discussed the matter "conceptually" with lawmakers. However, he also hinted that while it was "highly unlikely" he would actively fire Powell, he could not rule out the Fed Chair being held accountable for overspending on renovation costs.

"We have no plans to take any action... I don't rule out anything, but I think it's highly unlikely, unless he [Powell] has to leave because of fraud," Trump said at the White House.

Ultimately, the S&P 500 index still closed up 0.3% on Wednesday. The dollar also pared its losses to 0.2% in afternoon New York trading, and the 10-year Treasury yield nearly returned to its morning level, closing at about 4.45%.

Market False Alarm, But Wall Street Still Reeling

Of course, for financial markets, while the overnight rumors about Trump exploring "firing Powell" ultimately proved to be a false alarm, many on Wall Street are still reeling. Numerous industry insiders worry that firing Powell would pose a dangerous threat to the central bank's independence and could deal a severe blow to financial markets.

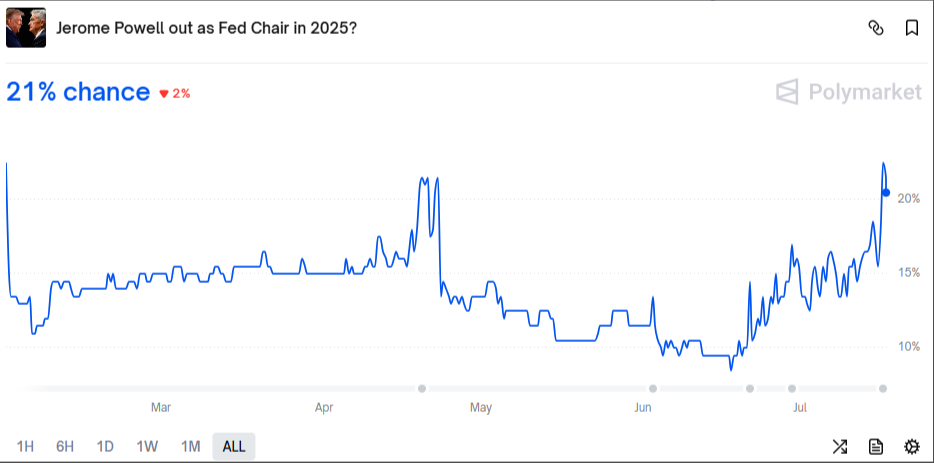

In fact, despite Trump's denial, some still expect Trump might soon attempt to oust Powell, although the US Supreme Court indicated in May it would block any such attempt. On some popular prediction platforms, the probability of Trump firing Powell has been steadily rising since June, suggesting bettors anticipate it happening.

Wednesday's bets on the Polymarket platform showed traders pricing in about a 24% chance of Trump firing Powell this year, the highest probability since the bet was created late last year.

The Fed's independence is a cornerstone of the US financial market. A collapse in the perception of the Fed's independence would cause immense damage to its reputation, almost impossible to repair. If the Fed's independence is perceived as compromised, it could trigger massive selling of the dollar and US government bonds, causing lasting harm to US markets and the economy, as well as its international standing.

Foreign exchange markets have been turbulent for months, with the dollar persistently weak, as Trump ramped up criticism of Powell, demanding the Fed lower interest rates. Veteran portfolio manager George Cipolloni stated this should be a danger signal for both investors and the White House.

"Trump wants lower rates: He thinks firing Powell would make a difference, but most market analysts believe it would signal a loss of Fed independence," wrote Greg Valliere, Chief US Policy Strategist at AGF Investments, in a report.

Marco Vailati, Head of Research & Investments at CASSA Lombarda, pointed out that whether Trump would act on this threat remains to be seen. But such a move would almost certainly cause market panic, as it would call into question whether the Fed is independent from political authority. A Fed perceived as weakened in independence and more subject to political leadership would raise concerns – less about solvency, and more about the reliability of the dollar as the world's reserve currency.

Dollar Assets Facing Potential Sell-off?

Attacks on the Fed's independence could also reignite the sell-off in US assets seen back in April this year.

Lee Hardman, Senior FX Analyst at MUFG London, said, "If this actually happened [Trump firing Powell], it would severely damage investor confidence in the dollar, which is why we started to see heavy selling; if he did it, this could persist further."

"It's not clear Trump has the authority to fire Powell, so we would expect legal challenges quickly, but even if overturned, the blow to confidence would be lasting, which also reinforces our bearish view on the dollar," Hardman added.

Francesco Pesole, FX Strategist at ING, also stated that if investors no longer perceive the Fed as independent, the dollar's strength and preeminent status could be threatened.

"An independent Fed is a key pillar of the dollar's reserve currency appeal," Pesole noted. "A currency is held as a reserve when there is a long-term market expectation that inflation will be controlled and the bond market will function smoothly. In the case of the dollar, the Fed's independence from politics fundamentally guarantees this. Therefore, if the market interprets a change in Fed leadership as a loss of independence, the incentive to hold dollars diminishes."

A weakening of the Fed's independence could also severely impact the US bond market. On Tuesday, the 30-year Treasury yield breached 5% for the first time since May. Regarding this, industry insiders noted that so far, 5% has acted as a ceiling for the 30-year yield. But if President Trump actually takes action to try to fire Fed Chair Powell, or imposes tariffs on trading partners at the rates mentioned in recent letters, then 5% could instead become the floor.

Cipolloni pointed out that the biggest risk now is that Trump could ultimately cause the bond market to lose confidence. If that happens, it could spell trouble for investors, homebuyers, and consumers.

"He [Trump] is not afraid to do unusual things; throughout his tenure, it seems he's done just that," he said. "But if yields rise to 5.5% or 6%, the bond market will show Trump who's really in charge. The stock market probably wouldn't like 5.5% long-term rates either."

Regarding US stocks, some also noted that given the sharp rally in recent months, the market may be vulnerable. The tech-heavy Nasdaq Composite hit another all-time high on Wednesday. Benson Durham, Global Head of Policy & Asset Allocation at Piper Sandler, said many investors are more focused on how the bond market would react to Powell's dismissal, "but I wouldn't forget stocks."

Louisiana Republican Senator John Kennedy stated on Wednesday that the stock market would crash if Trump fired Powell.

"If you fire the Fed chair, you would see the stock market crash. You would see the bond market crash," Kennedy said. "And on the other side, if Powell does what Trump wants, [easing] action, 'cut rates 300 basis points unilaterally,' you would see... chaos in the bond market, yields would actually go way up, which would have a huge impact on our ability to finance the government."