Please use a PC Browser to access Register-Tadawul

What You Can Learn From Paylocity Holding Corporation's (NASDAQ:PCTY) P/E After Its 25% Share Price Crash

Paylocity Holding Corp. PCTY | 105.66 | -2.37% |

Paylocity Holding Corporation (NASDAQ:PCTY) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

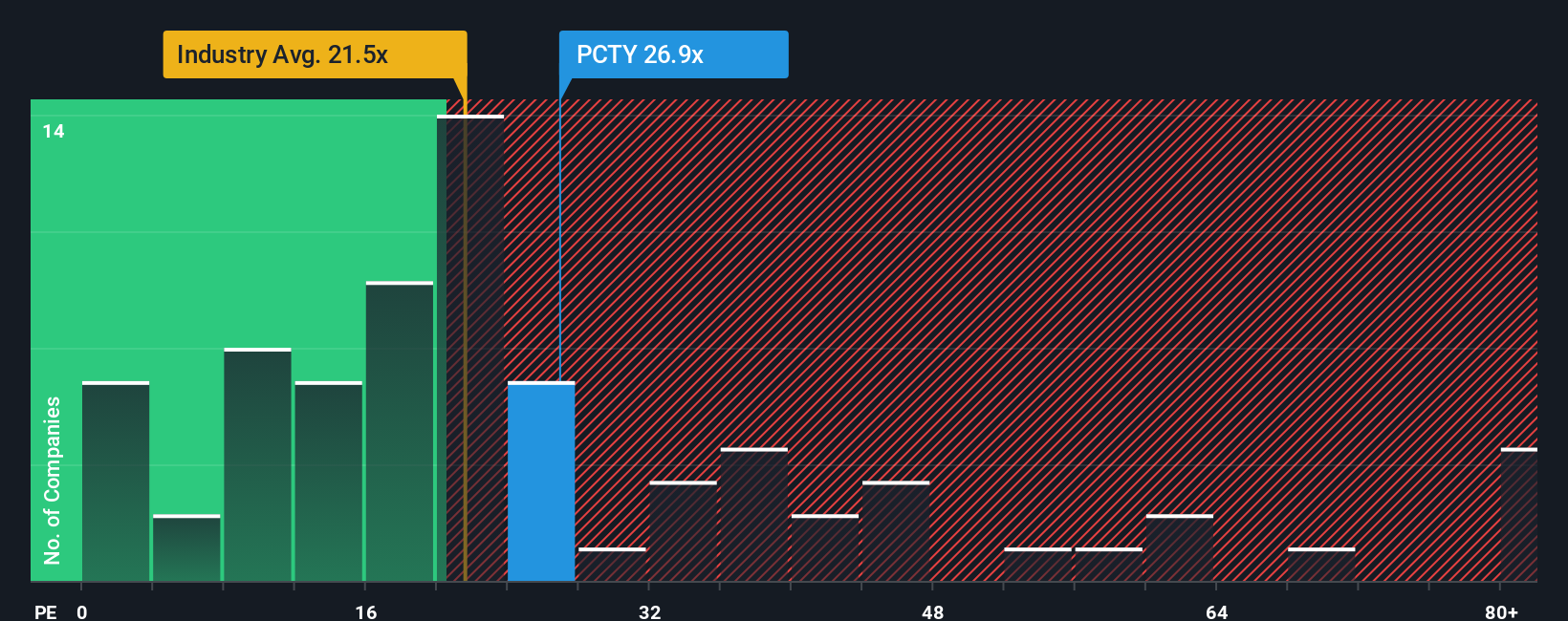

In spite of the heavy fall in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may still consider Paylocity Holding as a stock to potentially avoid with its 25.6x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Paylocity Holding's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Paylocity Holding would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 9.6%. Pleasingly, EPS has also lifted 153% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we can see why Paylocity Holding is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Paylocity Holding's P/E?

Paylocity Holding's P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Paylocity Holding maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Paylocity Holding with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Paylocity Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.