Please use a PC Browser to access Register-Tadawul

What You Can Learn From Saudi Real Estate Company's (TADAWUL:4020) P/E

ALAKARIA 4020.SA | 13.31 | +3.18% |

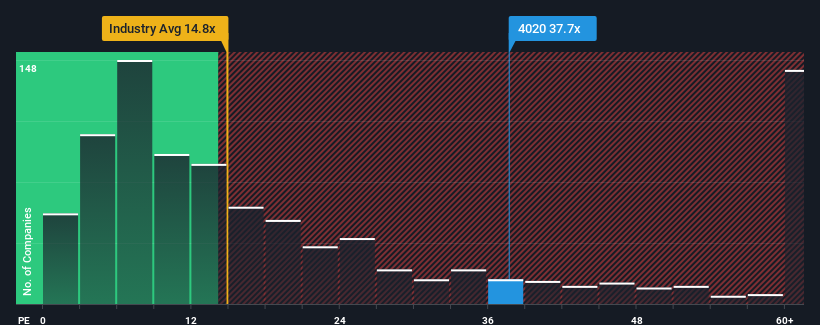

Saudi Real Estate Company's (TADAWUL:4020) price-to-earnings (or "P/E") ratio of 37.7x might make it look like a strong sell right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios below 22x and even P/E's below 16x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Saudi Real Estate has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Saudi Real Estate's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Saudi Real Estate's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 218%. The strong recent performance means it was also able to grow EPS by 151% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 24% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader market.

With this information, we can see why Saudi Real Estate is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Saudi Real Estate's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Saudi Real Estate's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Saudi Real Estate with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Saudi Real Estate's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.