Please use a PC Browser to access Register-Tadawul

Why Investors Shouldn't Be Surprised By LogicMark, Inc.'s (NASDAQ:LGMK) 31% Share Price Plunge

LogicMark, Inc. - Common Stock LGMK |

|

Unfortunately for some shareholders, the LogicMark, Inc. (NASDAQ:LGMK) share price has dived 31% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 93% share price decline.

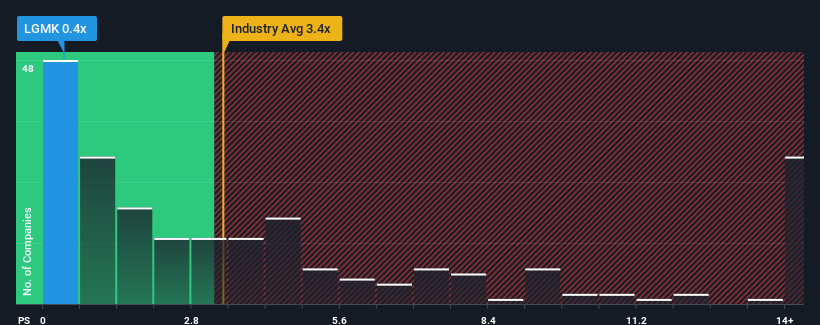

Following the heavy fall in price, LogicMark may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Has LogicMark Performed Recently?

The recent revenue growth at LogicMark would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on LogicMark will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for LogicMark, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For LogicMark?

LogicMark's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 1.0% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 9.1% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that LogicMark is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Shares in LogicMark have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of LogicMark revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with LogicMark, and understanding them should be part of your investment process.

If you're unsure about the strength of LogicMark's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.