Please use a PC Browser to access Register-Tadawul

Why Investors Shouldn't Be Surprised By Stepan Company's (NYSE:SCL) 26% Share Price Surge

Stepan Co SCL | 67.23 | +1.42% |

Despite an already strong run, Stepan Company (NYSE:SCL) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.9% in the last twelve months.

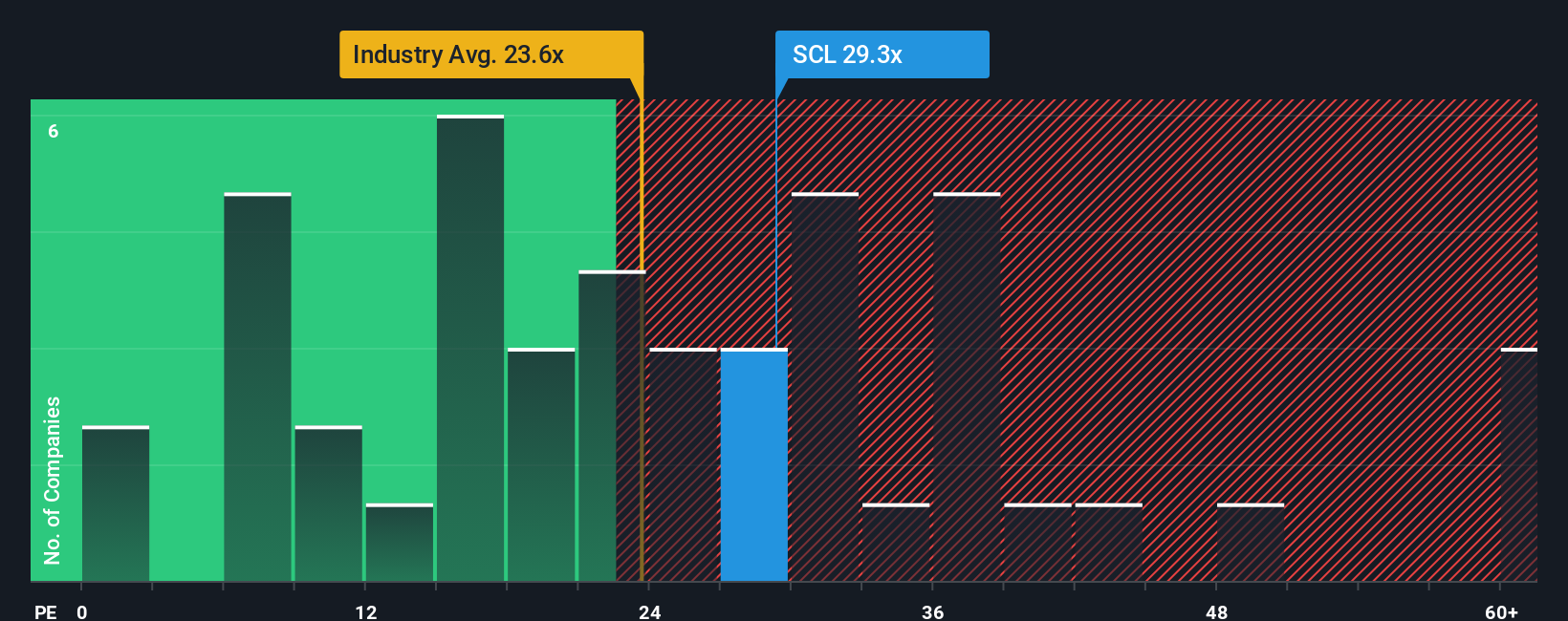

Since its price has surged higher, Stepan's price-to-earnings (or "P/E") ratio of 29.7x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 19x and even P/E's below 11x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Stepan's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

How Is Stepan's Growth Trending?

Stepan's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. The last three years don't look nice either as the company has shrunk EPS by 70% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 57% over the next year. With the market only predicted to deliver 16%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Stepan's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Stepan have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Stepan's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

If these risks are making you reconsider your opinion on Stepan, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.