Please use a PC Browser to access Register-Tadawul

With A 25% Price Drop For Wayfair Inc. (NYSE:W) You'll Still Get What You Pay For

Wayfair, Inc. Class A W | 100.08 | +1.52% |

Unfortunately for some shareholders, the Wayfair Inc. (NYSE:W) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

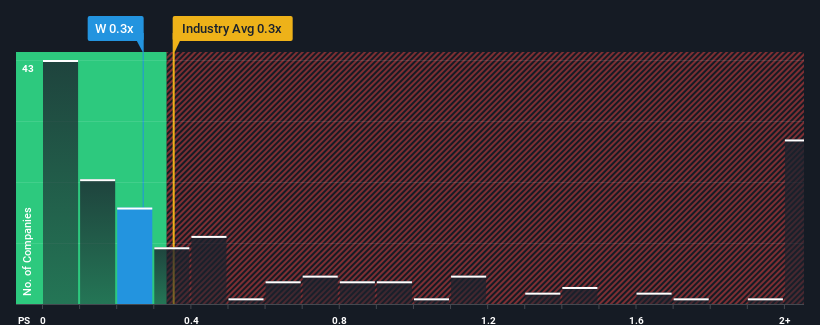

In spite of the heavy fall in price, it's still not a stretch to say that Wayfair's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Wayfair's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Wayfair's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wayfair .Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wayfair's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.3%. The last three years don't look nice either as the company has shrunk revenue by 14% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.1% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 5.8% per annum growth forecast for the broader industry.

With this information, we can see why Wayfair is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Wayfair's P/S?

Following Wayfair's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Wayfair's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Wayfair (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.