Please use a PC Browser to access Register-Tadawul

With A 30% Price Drop For Knightscope, Inc. (NASDAQ:KSCP) You'll Still Get What You Pay For

Knightscope, Inc. Class A KSCP | 3.32 | -0.60% |

Knightscope, Inc. (NASDAQ:KSCP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

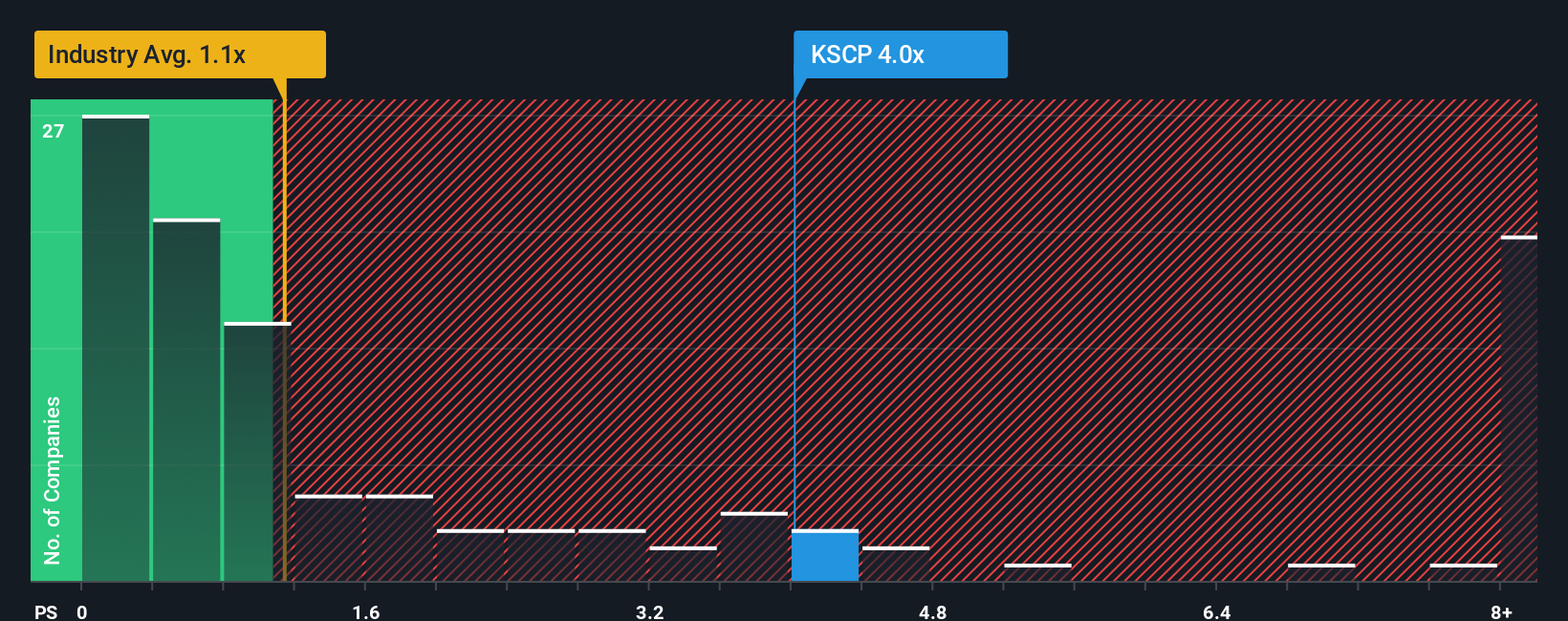

Although its price has dipped substantially, when almost half of the companies in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Knightscope as a stock not worth researching with its 4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Knightscope Has Been Performing

Knightscope hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Knightscope's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Knightscope's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.6%. Even so, admirably revenue has lifted 205% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 19% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 5.9% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Knightscope's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Knightscope's P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Knightscope maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.