Please use a PC Browser to access Register-Tadawul

With Helix Energy Solutions Group, Inc. (NYSE:HLX) It Looks Like You'll Get What You Pay For

Helix Energy Solutions Group, Inc. HLX | 8.94 | -1.76% |

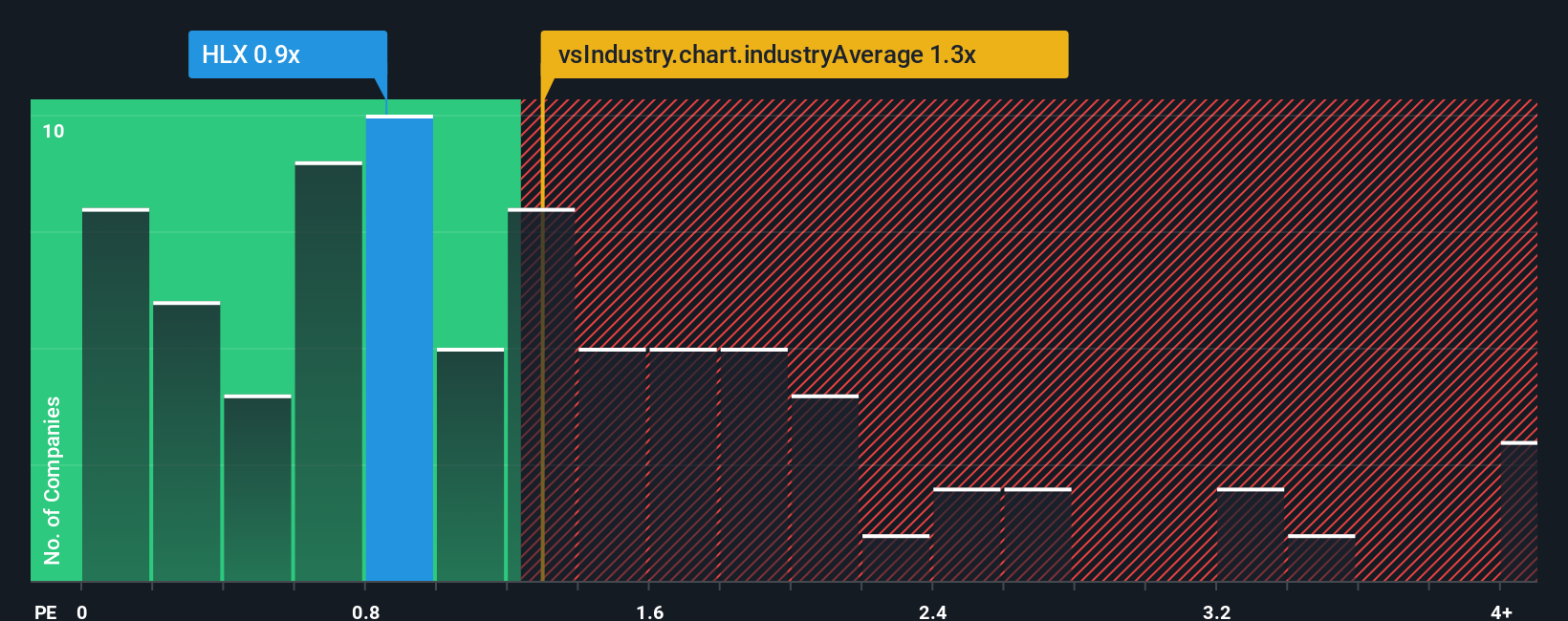

There wouldn't be many who think Helix Energy Solutions Group, Inc.'s (NYSE:HLX) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Energy Services industry in the United States is similar at about 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Helix Energy Solutions Group Performed Recently?

While the industry has experienced revenue growth lately, Helix Energy Solutions Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Helix Energy Solutions Group.How Is Helix Energy Solutions Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Helix Energy Solutions Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.0% decrease to the company's top line. Even so, admirably revenue has lifted 74% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.1% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.0% per year, which is not materially different.

With this in mind, it makes sense that Helix Energy Solutions Group's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Helix Energy Solutions Group's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Helix Energy Solutions Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You always need to take note of risks, for example - Helix Energy Solutions Group has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.