WSFS Financial (NASDAQ:WSFS) stock performs better than its underlying earnings growth over last five years

WSFS Financial Corporation WSFS | 0.00 |

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. Long term WSFS Financial Corporation (NASDAQ:WSFS) shareholders would be well aware of this, since the stock is up 100% in five years. And in the last week the share price has popped 5.8%.

The past week has proven to be lucrative for WSFS Financial investors, so let's see if fundamentals drove the company's five-year performance.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

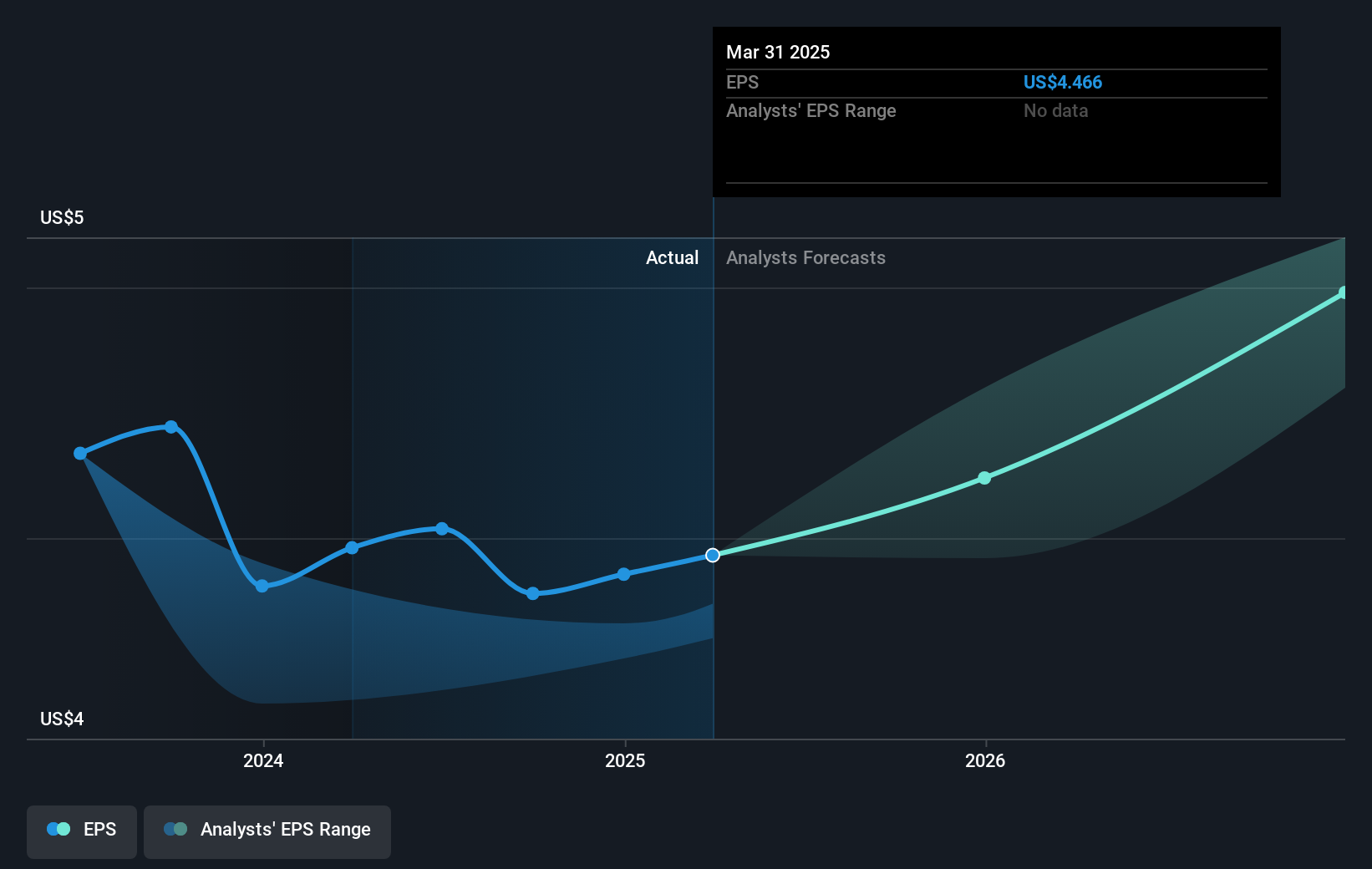

Over half a decade, WSFS Financial managed to grow its earnings per share at 11% a year. This EPS growth is lower than the 15% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for WSFS Financial the TSR over the last 5 years was 113%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that WSFS Financial shareholders have received a total shareholder return of 21% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 16%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research WSFS Financial in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course WSFS Financial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 03/11 11:03

CORRECTION: Resolute Holdings Mgmt Q3 Adj. EPS $0.13, Sales $120.865M Up From $107.135M YoY

Benzinga News 03/11 11:02LM Funding America Announces $1.5M Share Repurchase Program

Benzinga News 03/11 13:08CF Bankshares Q3 EPS $0.36 Misses $0.84 Estimate, Sales $15.508M Miss $15.880M Estimate

Benzinga News 03/11 14:20A Look at Equitable Hldgs's Upcoming Earnings Report

Benzinga News 03/11 15:03Federal Agricultural Q3 Adj. EPS $4.52 Beats $4.47 Estimate, Sales $105.086M Beat $101.025M Estimate

Benzinga News 03/11 21:11The National Down Syndrome Society and Voya Cares® Announce Winners of Two Grants for Entrepreneurs with Down Syndrome who Foster Inclusion and Community

Reuters 04/11 20:50Radian Group Q3 Adj. EPS $1.15 Beats $1.02 Estimate, Sales $237.103M Miss $238.900M Estimate

Benzinga News 04/11 22:29