Please use a PC Browser to access Register-Tadawul

Zimmer Biomet (ZBH) Margin Compression And One Off Loss Test Bullish Growth Narrative

Zimmer Biomet Holdings, Inc. ZBH | 98.75 | -0.50% |

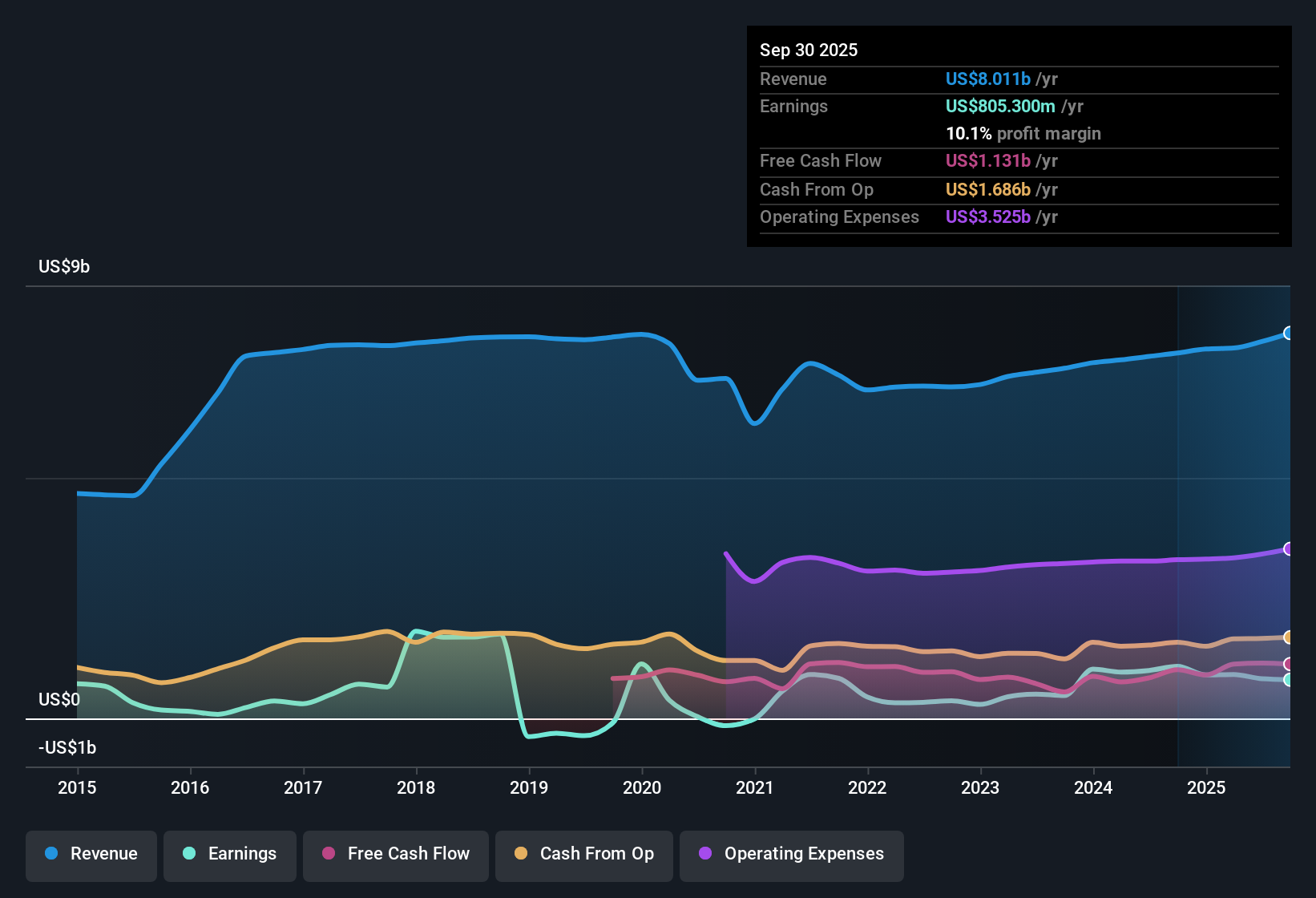

Zimmer Biomet Holdings (ZBH) has wrapped up FY 2025 with fourth quarter revenue of US$2.2b and basic EPS of US$0.71, alongside trailing twelve month EPS of US$3.56 on revenue of US$8.2b that reflects a net profit margin of 8.6% over the year. The company has seen quarterly revenue range from US$1.9b to US$2.2b through 2025, while basic EPS moved between US$0.71 and US$1.17, giving investors a clear view of how earnings tracked across the year against that full year margin outcome. With revenue steadily around the US$2b mark and margins coming in below the prior year, the latest print frames a results season focused squarely on profitability resilience and on where earnings growth could come from next.

See our full analysis for Zimmer Biomet Holdings.With the numbers on the table, the next step is to see how this earnings profile lines up with the main bull and bear narratives around Zimmer Biomet, and where the latest margin picture might support or challenge those views.

Margins Squeezed by One-Off Loss

- Over the last 12 months Zimmer Biomet generated US$8.2b of revenue with an 8.6% net margin, compared with 11.8% a year earlier, and that period also included a one-off loss of US$263.3m that weighed on reported profitability.

- Analysts' consensus view suggests that investments in robotics, digital health and higher end implants support higher margins over time. However, the current 8.6% margin and the one off loss show that, even with these growth areas, reported profitability can be pulled down when integration costs and exceptional items run through the income statement.

- The consensus narrative points to portfolio shaping and operational efficiencies helping adjusted margins, while the reported figures highlight that cash and accounting charges from acquisitions and new platforms can still be meaningful in the short term.

- With revenue growing around 3.6% a year, the recent margin compression underlines that the story is not only about top line expansion but also about how cleanly that revenue converts into profit after items like the US$263.3m loss.

3.6% Revenue Growth Versus Higher Earnings Aims

- Revenue over the last year grew about 3.6% annually to US$8.2b, while analyst data referenced in the summary points to expected earnings growth of roughly 18% a year, so the current set of numbers reflects a gap between modest sales growth and much faster profit growth targets.

- Consensus narrative supporters argue that exposure to an aging population, higher procedure volumes and premium products like robotics and digital platforms can support that earnings growth. However, the 3.6% revenue growth rate shows that, at least in the recent period, the top line has been expanding more slowly than those long term expectations.

- The commentary around expanding into higher growth segments such as extremities and ASC channels suggests potential for faster revenue, but the current figures still sit close to US$2.0b per quarter rather than showing a sharp acceleration.

- Forecasts for revenue to rise 5.5% a year and margins to move from 10.5% to 14.6% are being compared against a trailing margin of 8.6%, which means the path from today’s financials to those future numbers relies on both slightly faster sales growth and margin rebuilding.

Valuation Signals Versus Debt Load

- The stock is shown trading on a 25.7x P/E, below peer and industry averages of 54.4x and 33.2x, and also below a DCF fair value of US$211.39 compared with a current share price of US$91.40, while the company is also described as carrying a high level of debt.

- Supporters of the bullish narrative point to this gap between the current price and the DCF fair value, together with the forecast ~18% earnings growth, as a sign that the market might be pricing in the debt and recent margin compression quite heavily. This creates a tension between attractive valuation signals and the balance sheet risk that investors need to weigh carefully.

- The reference to earnings growing around 17.2% a year over the last five years is often used by bulls as a proof point, but the latest 8.6% margin and the one off loss show that this history also includes periods where reported profit growth has been uneven.

- Analyst targets around US$102.96 are closer to the current price than the DCF fair value, so investors comparing those two markers can see that even professional forecasts do not all point to the same conclusion about how the debt and recent results should be reflected in the share price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zimmer Biomet Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this earnings story points you in another direction, take a couple of minutes to shape your own view with Do it your way

A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Zimmer Biomet’s recent 8.6% net margin, one off US$263.3m loss and high debt highlight pressure on profitability and balance sheet strength versus bullish narratives.

If that mix of margin strain and leverage leaves you cautious, take a focused look at solid balance sheet and fundamentals stocks screener (45 results) to quickly find companies where financial footing looks firmer right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.