Please use a PC Browser to access Register-Tadawul

Zscaler (ZS) Valuation Spotlight After Annual Earnings Growth and Fresh Guidance

Zscaler ZS | 230.51 | +0.09% |

If you're following Zscaler (ZS), the company just reported its annual and fourth-quarter results, serving up a mix of growing revenue and updated guidance for the year ahead. This type of data-rich announcement often puts the spotlight on what investors should do next, especially when it arrives alongside forward-looking expectations. With revenue for the full year rising compared to last year and management offering a fresh look at what they anticipate next, the conversation now shifts from raw numbers to what those numbers might mean for future returns.

Stepping back, Zscaler’s stock is up an eye-catching 72% over the past year, handily outpacing the broader sector. While shares notched a small loss in the most recent quarter, the company’s year-to-date gain remains strong, and its momentum over several years is hard to ignore. Updates such as the latest earnings release and forward guidance help shape the current narrative around the stock’s growth potential and what kind of risk the market is assigning to its future.

With shares at these levels after such a run, the question stands: is Zscaler offering a window to buy into its next phase of growth, or is the market already anticipating what is to come?

Most Popular Narrative: 15.5% Undervalued

According to the most widely followed narrative, Zscaler is currently trading below its estimated fair value. This suggests the stock could offer upside from here if future earnings and growth measures unfold as projected.

Accelerating customer adoption of Zero Trust Everywhere and Data Security Everywhere solutions, particularly among Global 2000 and Fortune 500 firms, is fueling large upsell deals and higher ARR per customer. This should drive sustained double-digit revenue growth and improve net retention rates.

The fair value estimate is powered by bold expectations for what Zscaler’s next phase could look like. Curious what’s driving talk of big growth and higher multiples? There are a few headline figures soaring above typical forecasts. Eager to uncover the financial leap analysts believe could justify this valuation? The full narrative reveals the metrics behind Zscaler’s premium outlook.

Result: Fair Value of $324.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and increasing integration by public cloud giants could challenge Zscaler’s profitability and put pressure on its share of future cybersecurity budgets.

Find out about the key risks to this Zscaler narrative.Another View: How Does Its Price Compare?

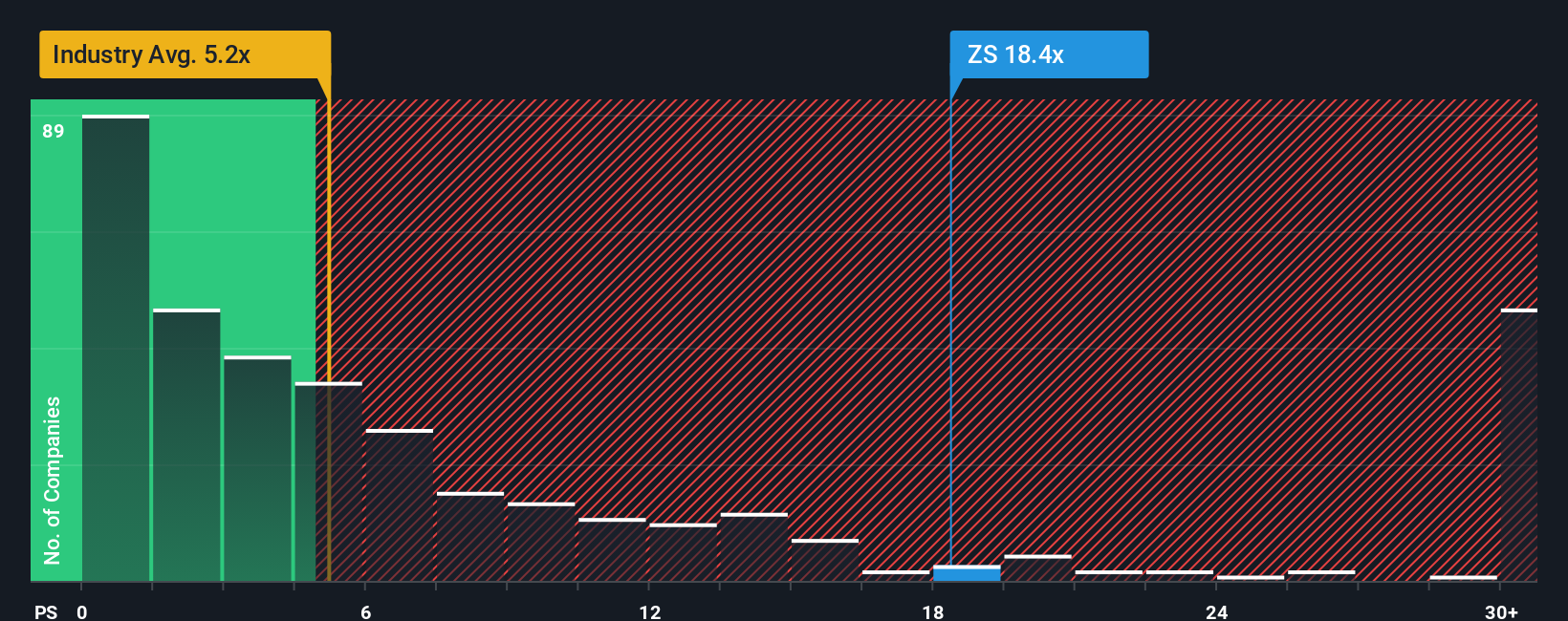

Looking at valuation from a different angle, the stock’s price relative to its sales is much higher than the sector’s average. This method suggests things may be too optimistic. Does growth justify this premium?

Build Your Own Zscaler Narrative

If you see things differently or prefer digging into the numbers on your own, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Your portfolio deserves more than just Zscaler. Unlock your next winning move by scanning the market for stocks with strong upside, proven financial health, or exposure to breakthrough technologies you might be overlooking.

- Spot undervalued gems using our tool for stocks trading below their intrinsic value. You can quickly access undervalued stocks based on cash flows to seize potential bargains before they're gone.

- Target reliable income streams by tracking companies with consistent, high dividend yields. All of these opportunities are at your fingertips with dividend stocks with yields > 3% to help boost your returns.

- Ride the wave of technology innovation by checking out fast-growing businesses at the intersection of healthcare and artificial intelligence. See the full landscape with healthcare AI stocks and position yourself for the next big thing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.