Please use a PC Browser to access Register-Tadawul

How to Trade U.S. Stocks in the Overnight Session

What is Overnight Trading?

Overnight trading for US stocks is a distinct session, separate from the regular pre-market, regular market, and after-hours periods. It is designed to accommodate global investors across different time zones, enabling nearly 24-hour trading alongside the other sessions.

Overnight Trading Hours

- Eastern Time (ET): Sunday–Thursday, 8:00 PM–4:00 AM (T+1)

- The first session each week runs from Sunday 8:00 PM to Monday 4:00 AM ET.

- The last session runs from Thursday 8:00 PM to Friday 4:00 AM ET.

| Time Zone | Overnight | Pre-Market | Regular Trading Hours | Post-Market |

|---|---|---|---|---|

Full Day | ||||

| Eastern time | 8:00 pm–4:00 am (+1) | 4:00 am–9:30 am | 9:30 am–4:00 pm | 4:00 pm–8:00 pm |

| KSA time | 3:00 am–11:00 am | 11:00 am–4:30 pm | 4:30 pm–11:00 pm | 11:00 pm–3:00 am (+1) |

Half Day | ||||

| Eastern time | 8:00 pm–4:00 am (+1) | 4:00 am–9:30 am | 9:30 am–1:00 pm | 1:00 pm–5:00 pm |

| KSA time | 3:00 am–11:00 am | 11:00 am–4:30 pm | 4:30 pm–8:00 pm | 8:00 pm–12:00 am |

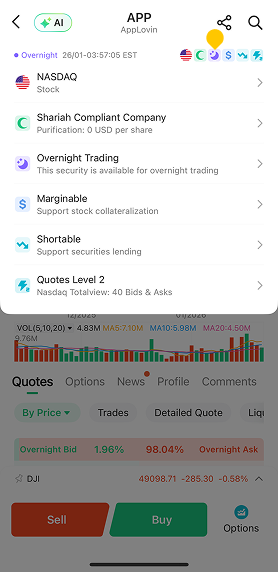

How to Identify Stocks Eligible for Overnight Trading on Sahm

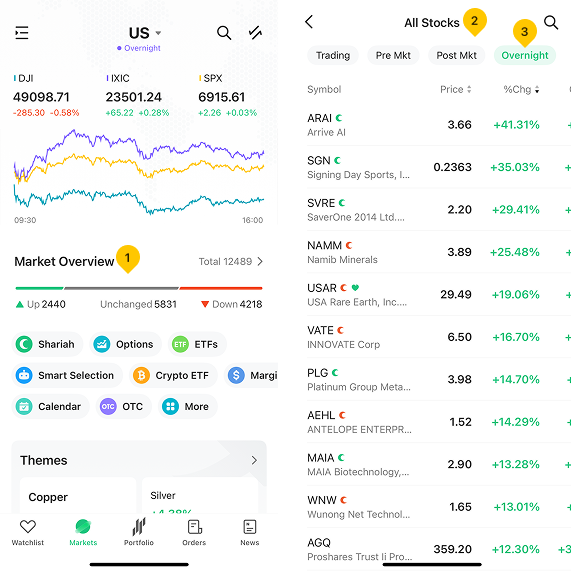

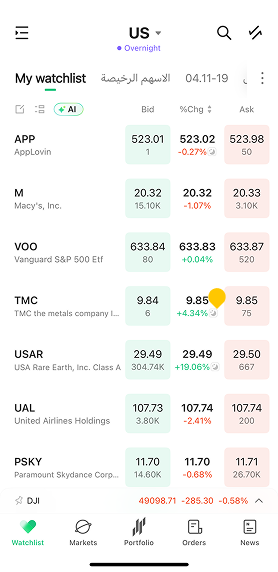

On the Sahm platform, you can quickly check whether a stock supports overnight trading in three ways:

- On the Stock Details Page, open any stock from Market or Watchlist. If you see a purple moon icon in the top-right corner, that stock supports overnight trading.

- On the Market Page, go to Market > Total, then tap the “Overnight” label to view a list of all stocks that support overnight trading.

- On the Watchlist Page, any stock with a moon icon next to it is eligible for overnight trading.

What Are the Advantages of Overnight Trading?

Overnight trading offers several key benefits:

1. Faster response to major news

Important events such as earnings releases, management guidance, and M&A announcements are often published after the U.S. market closes. Overnight trading lets you react and adjust your positions immediately, instead of waiting until the next regular session.

2. Longer trading hours and better use of capital

Regular trading hours provide a limited time window. With overnight trading covering most of the after‑hours and pre‑market period, your capital can stay in the market for longer and participate in more price movements.

3. More opportunities from price swings

Overnight sessions tend to combine concentrated news flow with lower liquidity, so prices may react more sharply to new information. For investors with a clear view, this higher volatility can create attractive trading opportunities.

4. Cross‑market trading flexibility

U.S. overnight trading often overlaps with other major markets, such as parts of Asia and Europe. You can adjust your U.S. positions based on overseas market performance and implement cross‑market strategies more flexibly.

What Are the Risks of Overnight Trading?

Overnight trading also comes with specific risks you should be aware of:

- Liquidity risk: lower activity and larger slippage

There are fewer participants and fewer orders in the book during overnight sessions. As a result, your actual trade price may deviate more from your expected price.

- Wider bid–ask spreads

The gap between the best bid and best ask is usually wider at night than during regular hours. This directly increases trading costs, especially for short‑term or frequent trading.

- Short‑term overreactions to news

Overnight trading often combines limited liquidity with concentrated news releases. This can lead to short‑term price overreactions. For example, a slightly better‑than‑expected earnings report may push the price well above its reasonable range, while negative interpretations of news may cause the price to be temporarily pushed down too far.

What Strategies Can Be Used for Overnight Trading?

1. Earnings Trading Strategy

Suitable for: Earnings releases, company guidance, major announcements.

How to use it:

Before the earnings release

- Form a view on whether results are likely to be above or below market expectations.

- Set a clear plan for both outcomes: what to do if the company beats or misses expectations.

After the earnings release (in the overnight session)

- Beat expectations: Consider adding to the position or taking profits on strength, depending on valuation and your current exposure.

- Miss expectations: Consider trimming, cutting losses, or waiting for sentiment to normalize during regular hours.

Risk control: Keep positions and stop-loss levels strictly managed to avoid large gains or losses driven by earnings “surprises.”

2. Trend Continuation / Reversal Strategy

Suitable for: Stocks that showed a clear trend during regular hours and may extend or reverse overnight.

- Trend continuation

If a stock rose on strong volume during the day and positive news is confirmed after the close, you may follow the trend in the overnight session. Use only part of your capital and set clear take-profit and stop-loss levels.

- Trend reversal

If post-close news clearly contradicts the day’s move (e.g., new regulation, lawsuits, negative events), you can use the overnight session to partially reduce positions or open hedges.

3. Volatility / Range Trading Strategy

Suitable for: Overnight sessions with large swings but no clear direction.

To handle patterns like “sharp spike then pullback” or “sharp drop then rebound”:

- Use small positions and scale in/out (build and reduce positions in batches) to capture price swings.

- Use limit orders rather than market orders to avoid poor fills caused by wide spreads.

4. Hedging and Risk Management Strategy

Suitable for: Investors with sizeable U.S. stock positions worried about overnight news risk.

When there are signs of major risk events (e.g., key macro data, geopolitical tensions, sector-specific bad news), you can reduce positions in core holdings during the overnight session, and/or use related ETFs or options to partially hedge your portfolio, so as to lower your overnight exposure and smooth potential shocks.