Please use a PC Browser to access Register-Tadawul

How Digi International's (DGII) Global IoT Modem Launch Could Shape Its Competitive Position

Digi International Inc. DGII | 45.09 | +3.16% |

- Digi International recently announced the release of the Digi XBee 3 Global LTE Cat 4 cellular modem, offering global pre-certifications, edge intelligence capabilities, and scalable remote management for high-bandwidth IoT applications.

- This product launch simplifies integration and device management for manufacturers, addressing industry demands for rapid deployment and robust, secure connectivity in demanding environments.

- We'll examine how the new modem’s global certifications and intelligent features could influence Digi International’s long-term business outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Digi International Investment Narrative Recap

To be a shareholder in Digi International, you need to believe in the company’s ability to drive growth through expansion in recurring, software-driven IoT revenue streams, despite flat guidance for overall revenue in 2025. The launch of the Digi XBee 3 Global LTE Cat 4 modem supports this narrative by making Digi’s high-value IoT ecosystem more accessible, but by itself may not materially move the needle on the short-term transition to recurring revenue, the most important near-term catalyst. The core risk remains execution on building recurring revenue and guarding against APAC demand softness or margin pressure from component costs.

Among recent announcements, the introduction of the Digi XBee 3 BLU module connects directly to this product launch by broadening Digi’s Bluetooth and LTE-powered device range. These product rollouts reinforce the catalyst of growing attach rates and adoption of subscription services for device management, tying near-term performance to how quickly Digi can translate its expanded portfolio into higher annual recurring revenue.

However, investors should weigh that the flip side of a broader IoT offering is exposure to regional volatility, such as ongoing uncertainty in APAC, which means...

Digi International is projected to reach $497.0 million in revenue and $72.6 million in earnings by 2028. This outlook assumes a 5.7% annual revenue growth rate and an $29.9 million increase in earnings from the current $42.7 million.

Uncover how Digi International's forecasts yield a $40.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

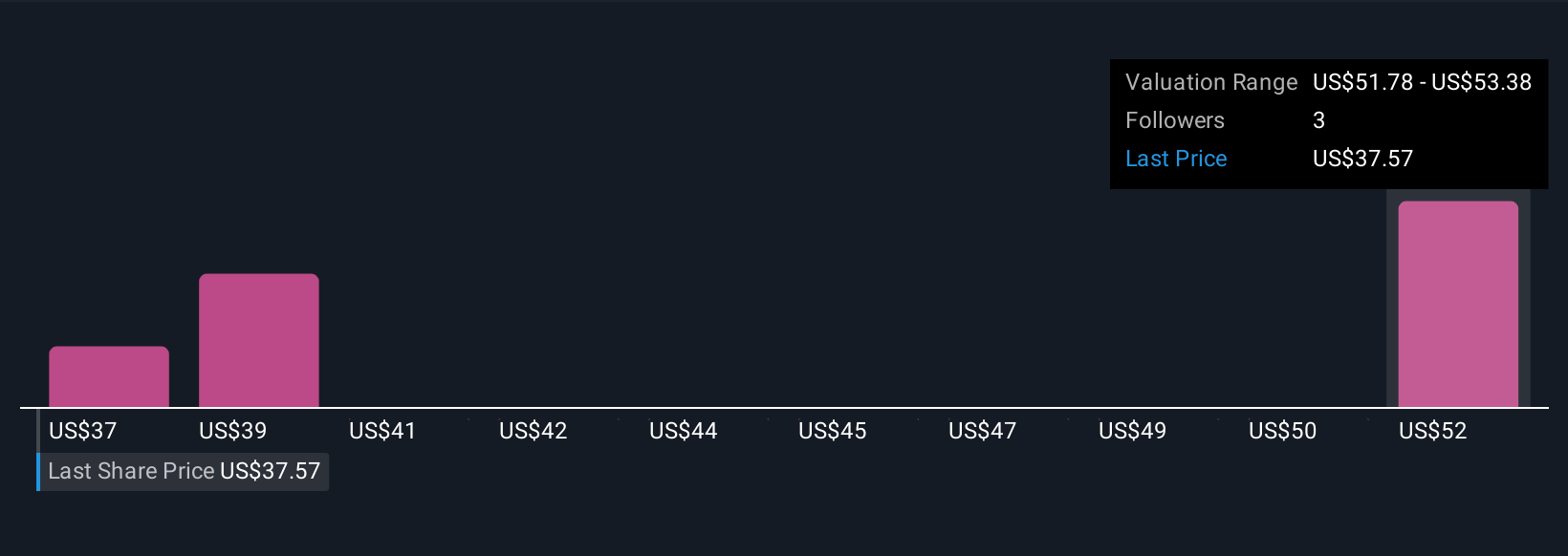

Simply Wall St Community members offer three fair value estimates for Digi International between US$37.38 and US$53.49 per share. While recurring revenue growth remains pivotal, your outlook on IoT adoption and regional demand could shape where you sit among these contrasting views.

Explore 3 other fair value estimates on Digi International - why the stock might be worth as much as 40% more than the current price!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.