Please use a PC Browser to access Register-Tadawul

How Outperforming Q2 Revenues and a Subscription Shift at Brink's (BCO) Has Changed Its Investment Story

Brink's Company BCO | 116.69 | +0.20% |

- Earlier this week, Brink's reported second quarter revenues surpassing analyst forecasts by 2.1%, fueled by higher-margin subscription-based revenues and strengthening operational efficiency.

- This performance led the company to raise its full-year expectations, highlighting a business model shift that stands out against mixed results from other security service providers.

- We'll explore how Brink's accelerated growth in subscription revenues and improved outlook influence its investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Brink's Investment Narrative Recap

At the heart of Brink's investment case is the conviction that recurring, higher-margin subscription and digital services will offset challenges in traditional cash management, helping the company adapt as global payment habits evolve. This quarter’s revenue beat and improved outlook reflect strong demand for these newer offerings, but the risk of accelerated cashless adoption and the need for faster digital transformation remain significant; while the recent results are encouraging, they do not materially change the most pressing long-term risk tied to cash usage trends.

Among recent announcements, the August 2025 completion of a substantial share buyback, repurchasing over 8% of shares, stands out. Returning capital to shareholders underscores management's confidence in the company's prospects, yet it also means less immediate investment in geographic or technological expansion that could help offset future pressures from declining cash usage.

Yet for all the optimism, investors need to weigh how a sudden shift toward a cashless economy could upend even the best-laid revenue forecasts...

Brink's narrative projects $6.0 billion revenue and $755.1 million earnings by 2028. This requires 5.5% yearly revenue growth and a $593.4 million earnings increase from $161.7 million today.

Uncover how Brink's forecasts yield a $128.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

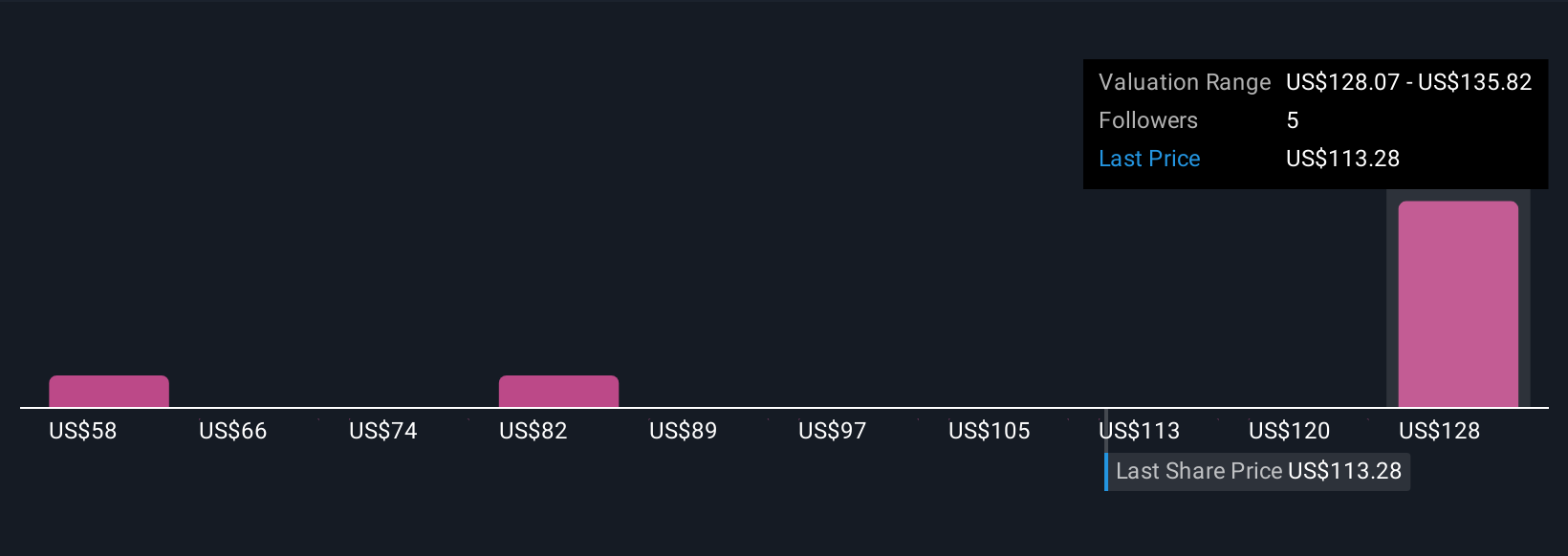

Four Simply Wall St Community members provide fair value estimates for Brink's, ranging from US$58.27 up to US$133.47. While some expect considerable upside from digital expansion, opinions differ widely, highlighting the importance of reviewing a variety of viewpoints before making decisions.

Explore 4 other fair value estimates on Brink's - why the stock might be worth 50% less than the current price!

Build Your Own Brink's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.