Please use a PC Browser to access Register-Tadawul

IonQ (NYSE:IONQ) Enters Japan Market With Toyota Tsusho Partnership to Advance Quantum Computing

IonQ, Inc. IONQ | 30.43 29.36 | -13.89% -3.52% Post |

This week, IonQ (NYSE:IONQ) announced a pivotal partnership with Toyota Tsusho Corporation to enhance quantum computing capabilities in Japan, marking a strategic entry into the Japanese market. This development aligns with the company’s continued global expansion. Over the week, IonQ's stock rose by 9.1%, which was consistent with the broader market's 2.3% increase. The positive momentum was also buoyed by the tech sector rally, notably led by chipmakers, adding weight to IonQ's rise. These market conditions supported the upward trend, potentially magnifying the impact of IonQ's expansionary news.

IonQ's shares have delivered a remarkable total return of 226.83% over the past year. This significant performance exceeds both the US Tech industry and the broader US market, which returned 17.8% and 5.9%, respectively, over the same one-year period. This shows IonQ's ability to achieve higher returns amidst broader market movements.

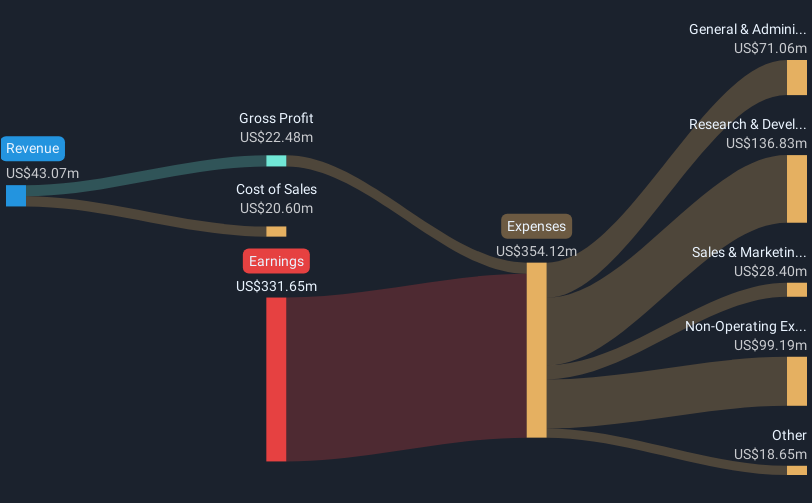

The strategic initiatives outlined in the introduction, including the partnership with Toyota Tsusho and IonQ's global expansion efforts, could positively impact the company's revenue and earnings forecasts. However, IonQ is expected to remain unprofitable over the next three years despite its revenue growth projections. The share price rise, in line with increased activity in the tech sector, positions IonQ to possibly capitalize on upcoming opportunities, although the company's securities currently trade at a significant premium to the consensus price target of US$40.60, based on today's context.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.