Please use a PC Browser to access Register-Tadawul

Is MPLX Trading Below Its Value After Five-Year 335% Price Surge?

MPLX LP MPLX | 55.86 | -0.04% |

- Thinking about whether MPLX is a bargain, overvalued, or somewhere in between? You are not alone if you are trying to figure out if now is the right time to buy in.

- The stock has climbed an impressive 22.4% over the last year and a huge 335.2% over five years. Recent weeks saw only subtle shifts, with a slight 0.6% dip in the past 7 days.

- Much of that performance has happened against a backdrop of renewed investor focus on energy infrastructure and pipeline assets. Sector news has highlighted stability and dividend consistency as major investor draws. Additionally, recent headlines about regulatory changes and M&A activity in the pipeline space have helped underpin confidence and occasionally moved the share price.

- MPLX’s valuation checks are strong, earning a 5 out of 6 on our scale, which puts it squarely among the value standouts in its sector. Next, we will walk through different valuation approaches, and we will wrap up with an even better way to understand what MPLX is truly worth.

Approach 1: MPLX Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. This approach helps determine whether the market price aligns with the company’s true earning power.

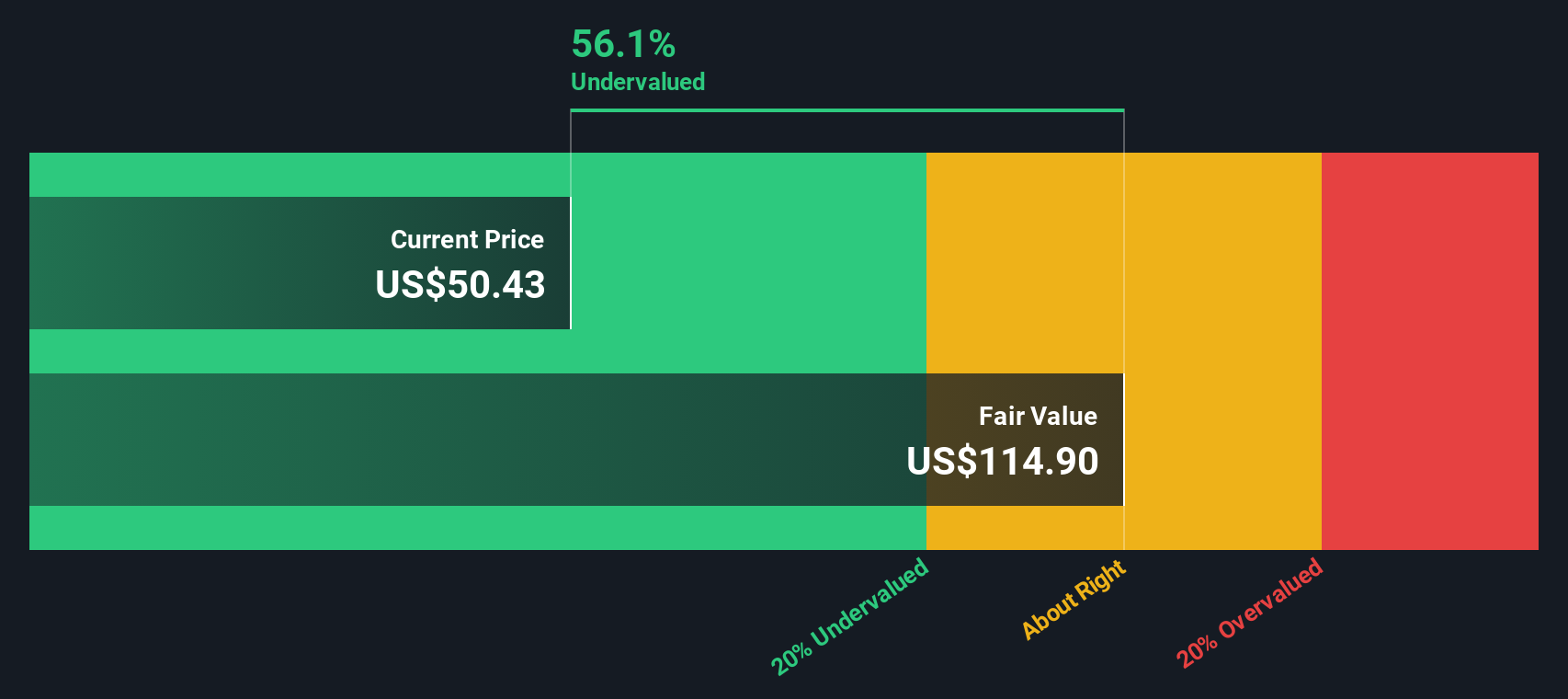

For MPLX, the latest reported Free Cash Flow is $5.01 billion, and analysts forecast this to grow steadily. By 2029, projections show annual FCF reaching $5.4 billion. Extended estimates using a two-stage model suggest FCF could reach $6.7 billion by 2035. While analysts tend to provide forecasts out to about five years, Simply Wall St extrapolates further to offer a longer-term perspective on value.

Based on this DCF analysis, the intrinsic value comes in at $116.77 per share. This result indicates a substantial 56.9% discount to MPLX’s recent share price, positioning the stock as significantly undervalued by the market according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MPLX is undervalued by 56.9%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: MPLX Price vs Earnings

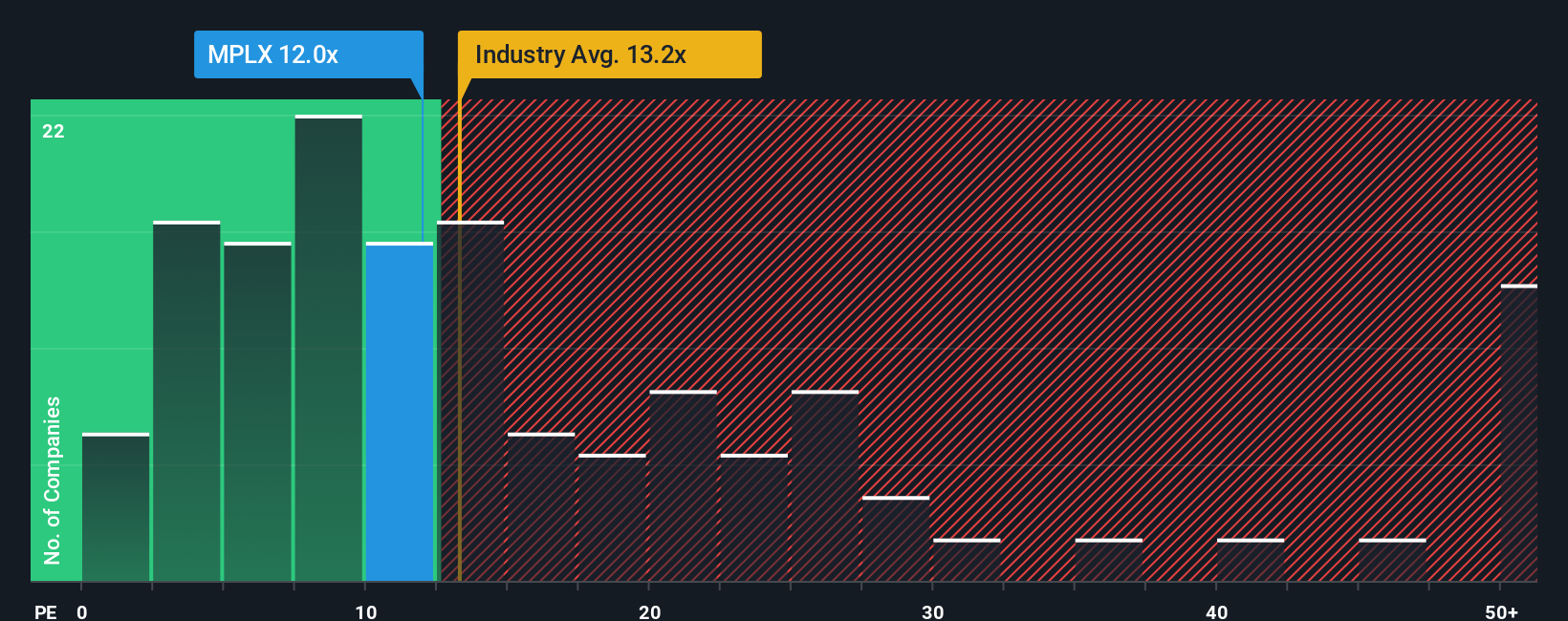

The Price-to-Earnings (PE) ratio is a widely used benchmark for valuing consistently profitable companies like MPLX, as it links the company's market value directly to its underlying earnings. For established businesses with predictable profits, the PE ratio offers a practical snapshot of how much investors are willing to pay for each dollar of earnings.

Interpretation of a “fair” PE ratio is shaped by expectations for future growth and the level of risk facing the company. Higher anticipated earnings growth or lower risk typically justify a higher PE, while slower growth or greater uncertainties can suppress what investors see as reasonable.

MPLX currently trades at 11.9x earnings, compared to the industry average of 12.8x and a peer average of 14.6x. At first glance, this suggests MPLX could be relatively inexpensive compared to others in the oil and gas sector. However, Simply Wall St's Fair Ratio calculation, which blends forward-looking growth estimates, profit margins, risk profile, industry dynamics, and company size, sets MPLX’s fair PE at 19.1x.

The Fair Ratio is a more reliable benchmark than narrow comparisons with industry or peers, as it goes beyond surface numbers to factor in nuanced drivers such as MPLX's specific growth prospects, risks, and scale. When comparing MPLX’s current PE to its fair ratio, the stock trades well below this level, strengthening the case for its shares being undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MPLX Narrative

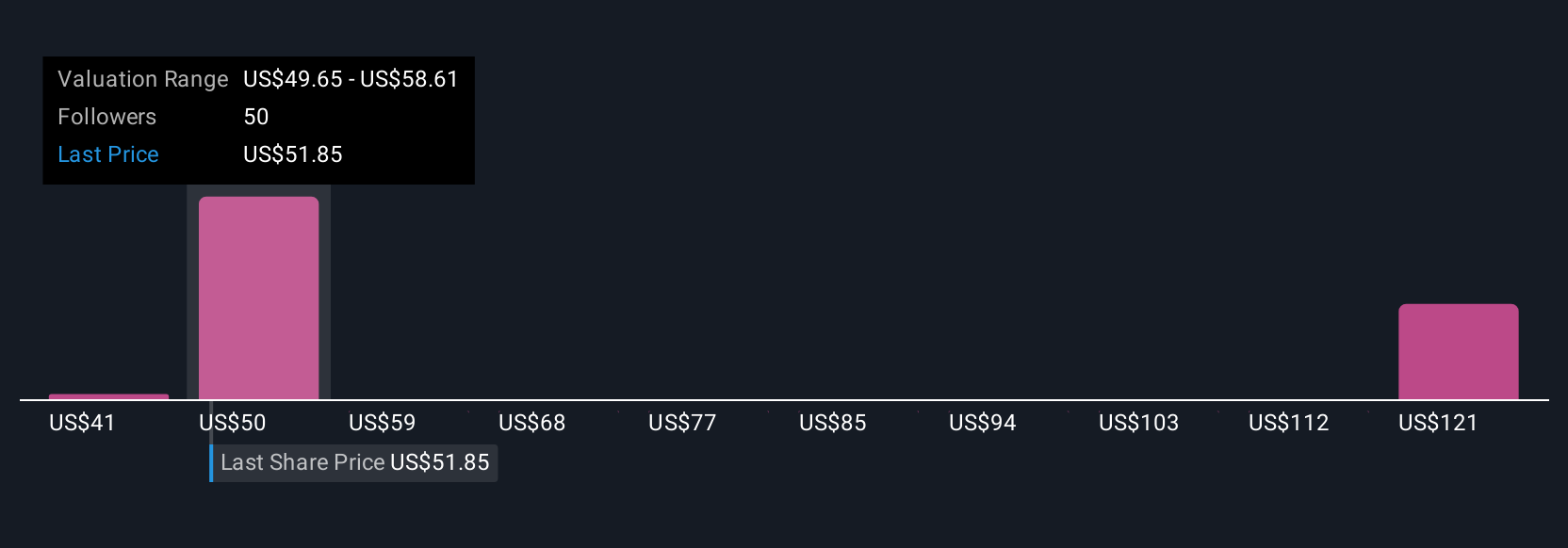

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven framework that lets investors go beyond the numbers by outlining their own perspective and expectations for a company, such as assumptions about MPLX’s fair value, future revenues, earnings, and profit margins. These stories are then linked directly to financial forecasts and a calculated fair value.

On Simply Wall St’s Community page, anyone can create and share Narratives, making it an accessible and powerful tool already used by millions of investors. By crafting or following a Narrative, you can quickly see how different assumptions affect a company’s fair value and compare that against the current market price. This process helps you decide whether to buy, hold, or sell.

A key advantage is that Narratives update dynamically as new facts, earnings reports, or industry news emerge, so your investment outlook stays relevant and actionable. For example, some investors believe MPLX’s expansion and contract stability justify a price target as high as $64. More cautious perspectives focus on sector risks and set a much lower target of $51. This illustrates how Narratives turn financial analysis into a living, personal story.

Do you think there's more to the story for MPLX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.