Please use a PC Browser to access Register-Tadawul

Is PayPal a Hidden Bargain After Leadership Shifts and Industry Uncertainty in 2025?

PayPal Holdings Inc PYPL | 62.28 | +0.89% |

- Ever wondered if PayPal Holdings is a hidden bargain or a value trap? You are not alone, and the answer might surprise you.

- Despite a 2.4% gain over the past week, the stock is still down 19.1% year-to-date, and shares have fallen 10.9% over the last year. This paints a complicated picture for investors watching its trajectory.

- Recent headlines have focused on PayPal’s ongoing strategic moves in the payments industry, including leadership shifts and expansion of digital wallet offerings. These stories have sparked plenty of debate and seem to fuel both optimism and skepticism about what is next for the stock.

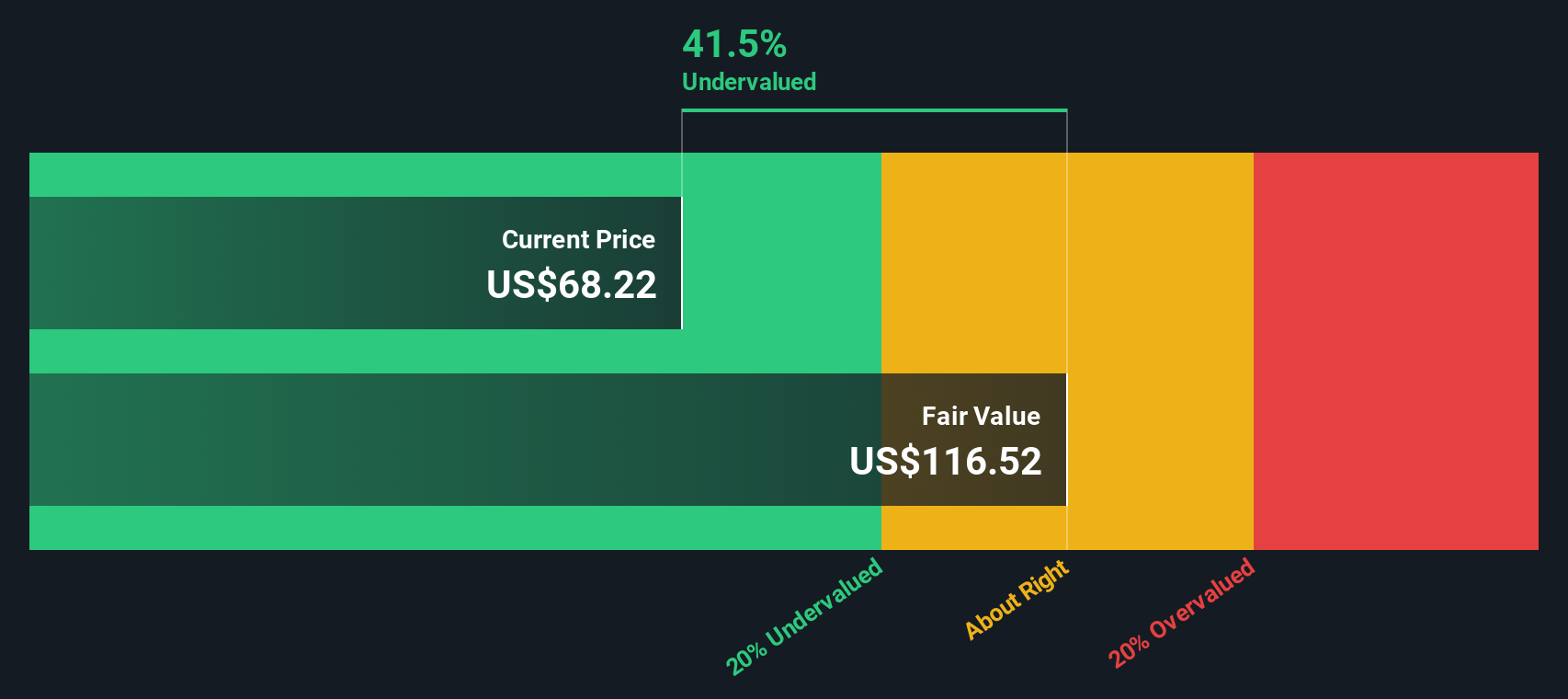

- Our first step is a valuation check. PayPal Holdings scores a 5 out of 6 for being undervalued, an impressive mark that points to a potential opportunity. However, the real insight comes when we dig deeper into the methods behind the score and explore an even more compelling approach at the end of the article.

Approach 1: PayPal Holdings Excess Returns Analysis

The Excess Returns model examines how much value a company generates above the required return on its equity, focusing on return on invested capital and its sustainability over time. This approach centers on whether PayPal Holdings is able to create more earnings for shareholders than it costs to fund its equity investments.

PayPal’s current Book Value stands at $21.46 per share. Its projected Stable Book Value is $25.40 per share according to estimates from eight analysts. The company’s Stable Earnings Per Share (EPS) are expected to reach $6.13, as calculated from future Return on Equity projections by eleven analysts. With a cost of equity at $1.96 per share, PayPal's Excess Return comes out to $4.17 per share, signaling the company’s ability to consistently generate value beyond its capital costs. Its average Return on Equity is an impressive 24.14%, reflecting strong profitability compared to industry norms.

According to this model, the estimated intrinsic value for PayPal stock suggests it is trading at a 39.4% discount to its fair value, indicating substantial undervaluation at current prices. This supports the argument that PayPal may represent an attractive opportunity for long-term investors willing to look beyond short-term volatility.

Result: UNDERVALUED

Our Excess Returns analysis suggests PayPal Holdings is undervalued by 39.4%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: PayPal Holdings Price vs Earnings

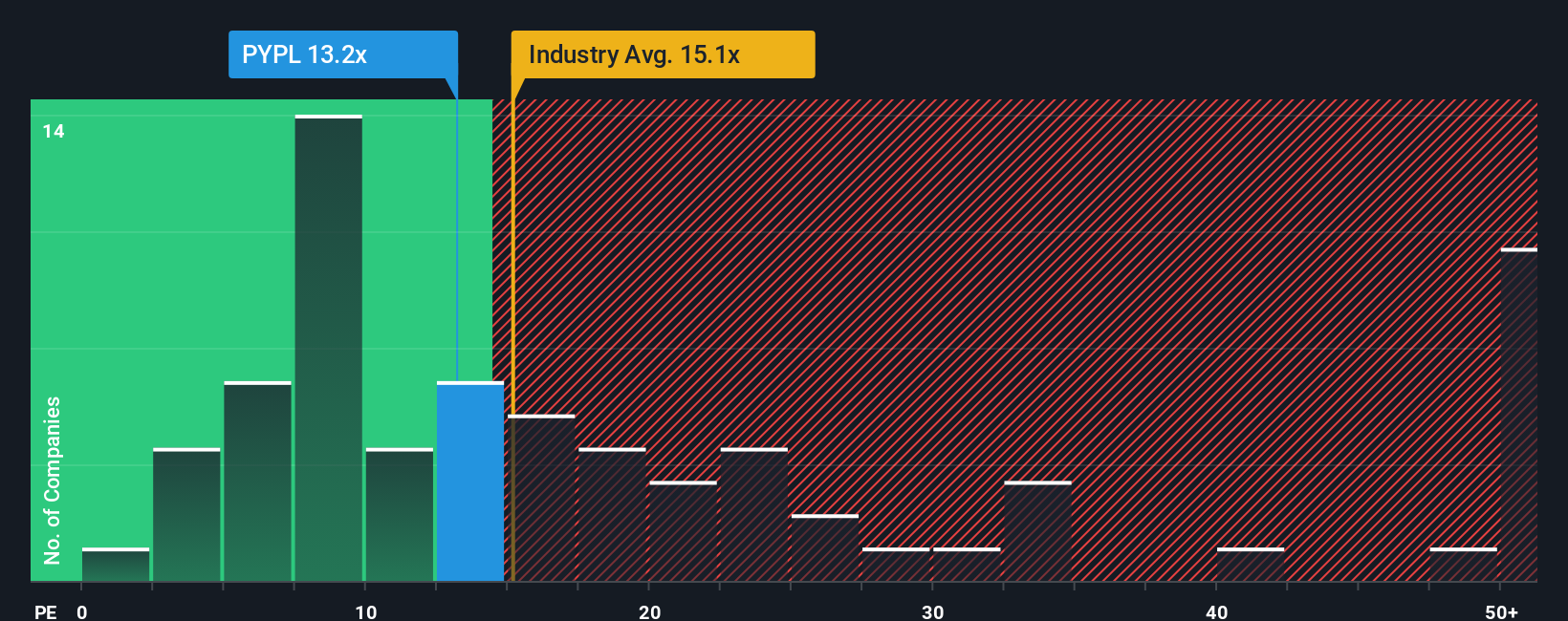

The Price-to-Earnings (PE) ratio is a popular and suitable valuation metric for profitable companies like PayPal Holdings. It tells investors how much they are paying for each dollar of earnings, which is especially relevant for businesses with stable profitability. A company's PE ratio provides quick insight into how the market values its current and future profit potential.

What counts as a “normal” or “fair” PE ratio can vary across industries and growth profiles. Generally, a higher expected earnings growth rate or lower perceived risk justifies a higher PE, while companies facing more uncertainty or slower growth often command lower multiples. As of now, PayPal’s PE stands at 13.34x, which is lower than both the Diversified Financial industry average of 15.05x and its peers’ average of 14.55x. This suggests that, on a basic comparison, PayPal trades at a discount to competitors.

However, peer and industry benchmarks do not tell the whole story. Simply Wall St’s “Fair Ratio” adjusts the PE for factors such as PayPal’s projected earnings growth, market cap, profit margin and specific risks. For PayPal, the Fair Ratio is estimated at 18.80x, which is higher than its current PE of 13.34x. This proprietary metric is far more comprehensive than conventional comparables and provides a sharper view of true value by accounting for company-specific characteristics alongside industry context.

Since PayPal’s PE is well below its Fair Ratio, the stock appears undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PayPal Holdings Narrative

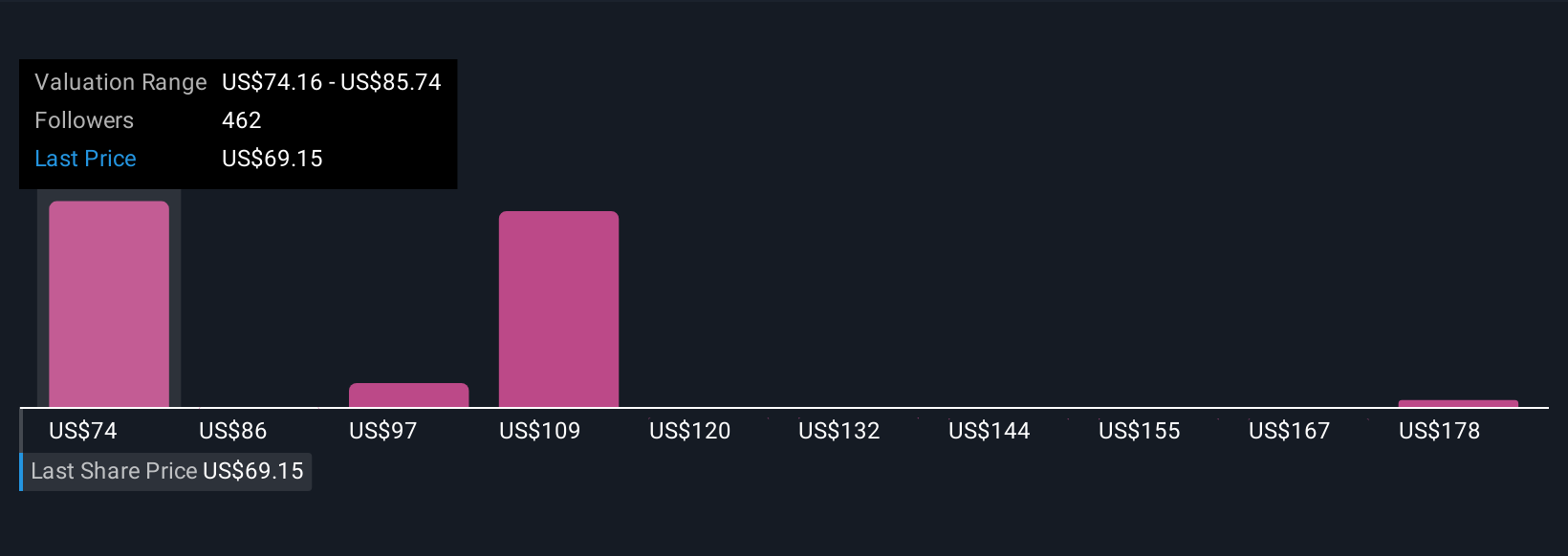

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple but powerful tool that let investors tell the story behind a company's numbers by linking their own financial forecasts and fair value estimates to their personal perspective on its future.

Instead of relying solely on rigid metrics, Narratives connect PayPal Holdings’ real-world story, including its growth drivers, risks, and industry changes, to a financial forecast and ultimately a fair value. They are easy to create and explore within Simply Wall St's Community page, used by millions of investors, and are designed to be accessible for everyone, whether you are just starting out or already an expert.

With Narratives, you can clearly see if a stock is a buy or sell by comparing your Fair Value against today's Price. Dynamic updates ensure your Narrative automatically responds to new information, such as earnings or news events, as soon as they emerge.

For PayPal Holdings, for instance, some investors project a fair value as high as $133.95 if future growth in Venmo and merchant solutions plays out, while others see a more cautious outlook near $82.22 reflecting competitive pressures and margin challenges. This demonstrates how the Narrative approach showcases the full spectrum of market perspectives in real time.

Do you think there's more to the story for PayPal Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.