Please use a PC Browser to access Register-Tadawul

PJT Partners (PJT): Evaluating Valuation After Record Results and Upcoming Goldman Sachs Conference Appearance

PJT Partners, Inc. Class A PJT | 179.87 179.87 | -0.86% 0.00% Pre |

PJT Partners (PJT) is back in the spotlight after reporting record operational results and lining up a high profile appearance at the Goldman Sachs Financial Services Conference, a combination that has sharpened investor focus on the stock.

The stock has reacted to that backdrop with a 3.1% 1 day share price gain and a 5.8% 7 day share price return, and while the 1 year total shareholder return of 11.6% is solid rather than spectacular, the three year total shareholder return of 130.2% suggests momentum is still very much intact.

If PJT’s run has you thinking about what else might be gaining traction, now is a good time to explore fast growing stocks with high insider ownership as potential next ideas.

Yet with PJT now trading essentially in line with analyst targets after a powerful multi year run, investors face a tougher question: is this just fair value for a high quality franchise, or is the market still underestimating its future growth?

Price-to-Earnings of 24x: Is it justified?

On a price-to-earnings ratio of 24x at a last close of $176.04, PJT Partners screens slightly expensive versus close peers but roughly in line with its broader industry.

The price-to-earnings multiple compares the current share price with the company’s earnings per share, making it a common yardstick for capital markets firms where profit cycles can be pronounced. For PJT, a 24x multiple suggests investors are willing to pay a premium for each dollar of earnings, likely reflecting confidence in the durability of its advisory franchise and its recent acceleration in profit growth.

Relative signals are mixed. PJT is labeled good value versus the wider US Capital Markets industry at around 25x, yet looks expensive against a tighter peer group where the average multiple is closer to 16.4x. That gap implies the market is pricing in stronger or more resilient earnings than the typical peer, and that premium would need ongoing execution and growth to be sustained.

Result: Price-to-Earnings of 24x (OVERVALUED)

However, slowing deal activity or a sharper than expected downturn in restructuring mandates could challenge the sustainability of PJT’s premium valuation and earnings trajectory.

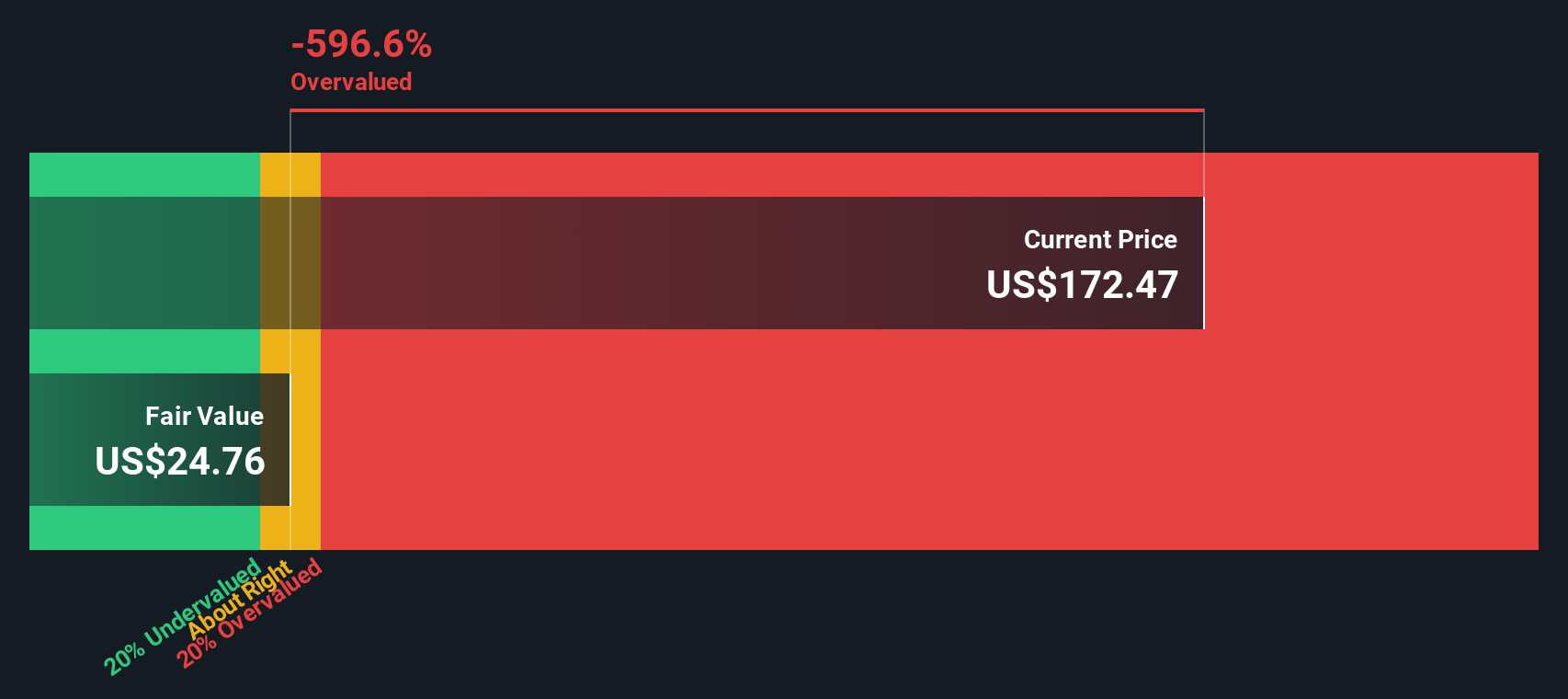

Another View: Our DCF Model Flags Rich Pricing

Our DCF model paints a much starker picture, suggesting PJT’s fair value is closer to $25.99 versus the current $176.04, implying the shares may be significantly overvalued. If both views are right in their own way, which one will the market ultimately follow?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PJT Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PJT Partners Narrative

If you see the numbers differently or simply want to stress test these assumptions yourself, you can build a personalized view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PJT Partners.

Ready for your next investing edge?

Before PJT becomes yesterday’s headline, lock in your next move by scanning high conviction stock ideas on Simply Wall Street’s powerful screener tools.

- Capture mispriced opportunities early by using these 904 undervalued stocks based on cash flows that could reshape your portfolio’s long term return profile.

- Capitalize on structural shifts in medicine and diagnostics with these 30 healthcare AI stocks at the intersection of data, algorithms, and patient outcomes.

- Boost your income potential and keep cash working harder through these 15 dividend stocks with yields > 3% offering attractive yields with room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.