Please use a PC Browser to access Register-Tadawul

US$500 Million Buyback and SoHo Deal Could Be A Game Changer For Empire State Realty Trust (ESRT)

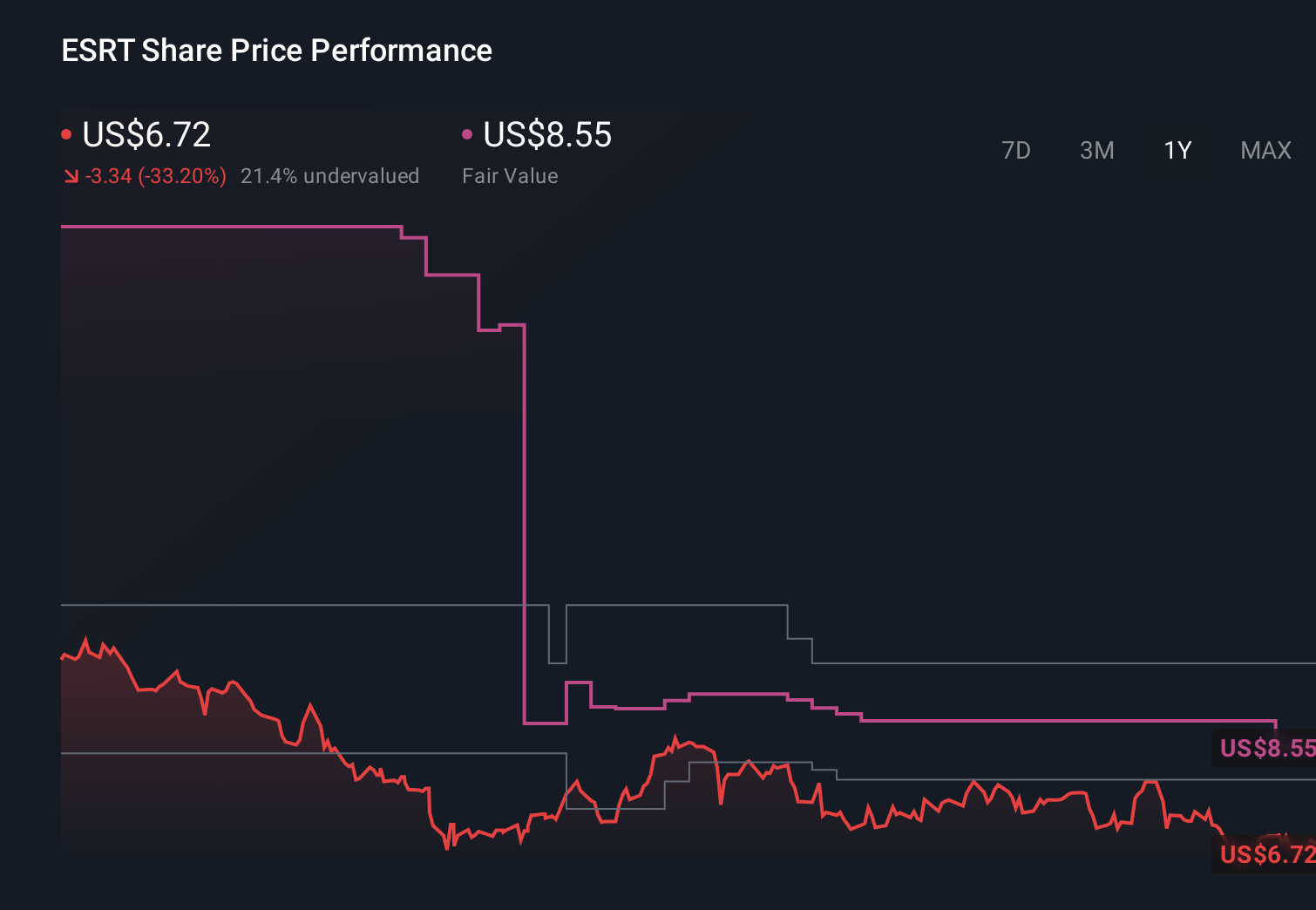

Empire State Realty Trust, Inc. Class A ESRT | 5.93 | -2.15% |

- In early December 2025, Empire State Realty Trust announced a US$386 million all-cash acquisition of Scholastic’s SoHo headquarters building and its Board approved a fourth-quarter dividend of US$0.035 per share, alongside a new share repurchase authorization of up to US$500 million running through December 31, 2027.

- Together, the SoHo purchase and sizable buyback plan highlight management’s willingness to redeploy capital into prime Manhattan assets while returning cash to investors through dividends and repurchases.

- Next, we’ll examine how the US$500 million repurchase authorization may reshape Empire State Realty Trust’s existing investment narrative and risks.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Empire State Realty Trust Investment Narrative Recap

To own Empire State Realty Trust, you need to believe in the resilience of high quality New York City real estate and the company’s ability to offset office and Observatory headwinds with thoughtful capital deployment. The Scholastic Building acquisition and new US$500 million repurchase authorization do not remove key near term risks around tourism driven Observatory softness and rising operating costs, but they may become near term catalysts if execution and leasing progress at SoHo remain on track.

The new US$500 million share repurchase authorization, which runs through the end of 2027, is the most directly relevant announcement for investors weighing the current thesis. Its scale relative to recent earnings and ESRT’s share price performance could meaningfully influence per share metrics and the stock’s risk reward profile, particularly as the company balances this program against ongoing capital expenditure needs and the integration of the SoHo asset.

Yet investors should be aware that rising real estate taxes and maintenance costs continue to pressure margins and could...

Empire State Realty Trust's narrative projects $797.6 million revenue and $13.7 million earnings by 2028. This requires 1.5% yearly revenue growth and an earnings decrease of $26.7 million from $40.4 million today.

Uncover how Empire State Realty Trust's forecasts yield a $8.55 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$8.55 to US$13.28 per share, underscoring how far opinions can diverge. Against this, ESRT’s exposure to higher operating expenses and capital needs for modernizing assets may weigh on how each investor views the company’s ability to translate its NYC footprint into sustainable long term returns, so it can be useful to compare several of these viewpoints side by side.

Explore 2 other fair value estimates on Empire State Realty Trust - why the stock might be worth just $8.55!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.