Please use a PC Browser to access Register-Tadawul

What Element Solutions (ESI)'s Electronics Surge and Upgraded Guidance Mean for Shareholders

Element solutions ESI | 26.39 | +0.46% |

- Element Solutions Inc. recently reported strong second-quarter results, highlighting a 9% organic sales increase in its electronics segment and raising its full-year adjusted EBITDA guidance to between US$530 million and US$550 million, while also announcing the commissioning of a new manufacturing site for its Cuprion active copper product.

- This performance underscores the company's focus on innovation and expansion in advanced electronics and semiconductor markets, as well as management's optimism despite industry headwinds and uneven conditions across other business segments.

- We'll look at how Element Solutions' strong electronics growth and upgraded guidance may influence the company's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

Element Solutions Investment Narrative Recap

To be a shareholder in Element Solutions, you generally need conviction in the company’s ability to sustain growth in advanced electronics and capitalize on demand from high-performance computing and data center customers. While the recent 9% organic sales increase in electronics and new EBITDA guidance validation support this narrative, the biggest near-term catalyst, further semiconductor growth, could still be challenged by uneven performance in legacy and industrial segments; the short-term impact of the latest news does not fundamentally change this risk.

The company’s announcement of the new Cuprion active copper manufacturing site is highly relevant, as it connects directly to the focus on next-generation semiconductor materials and expands Element Solutions’ exposure to products with higher growth and margin potential in the electronics segment, the central driver of its improved outlook.

On the other hand, investors should be aware of persistent softness in industrial demand and the risk that electronics growth may be...

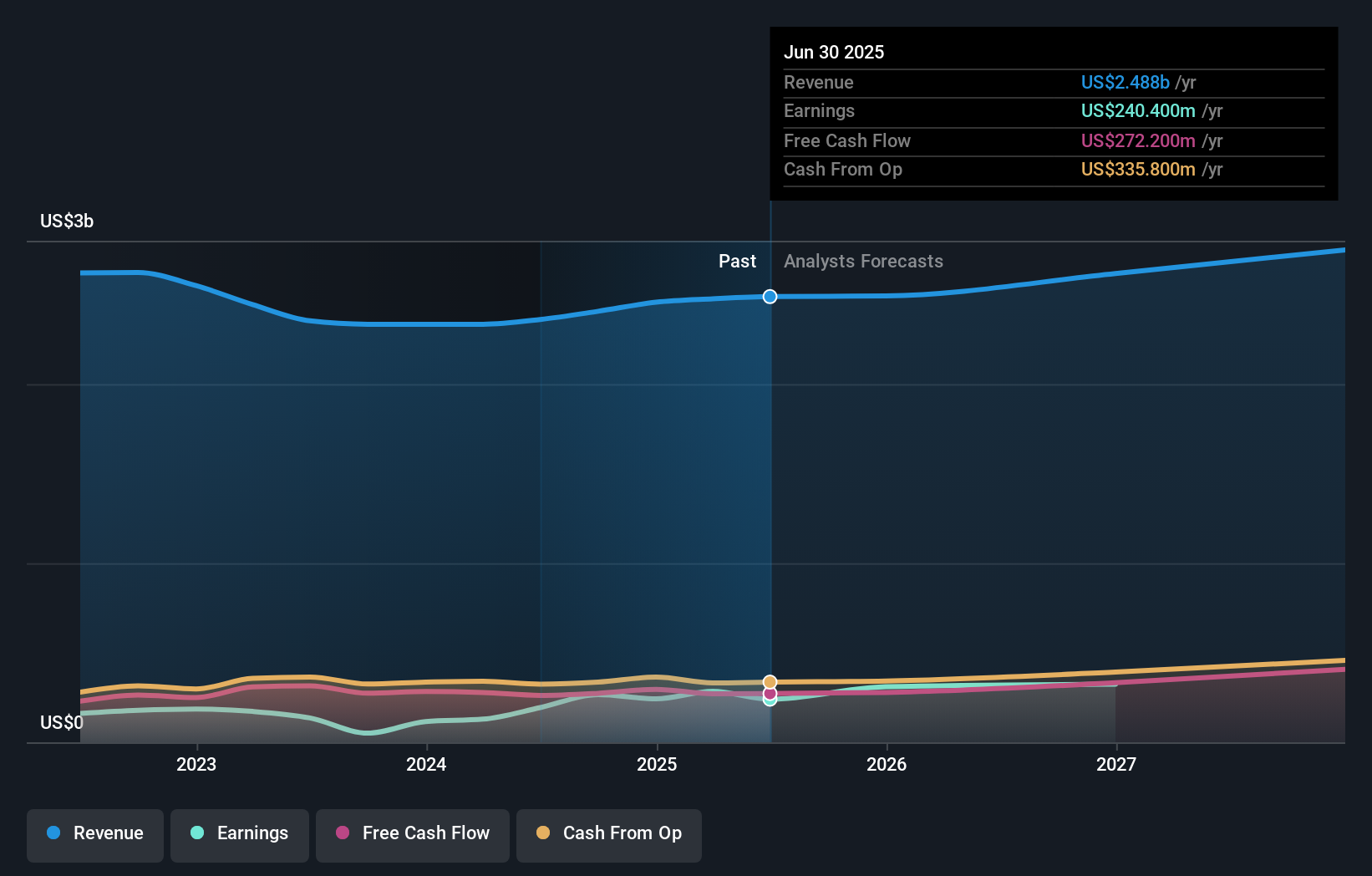

Element Solutions is projected to reach $2.8 billion in revenue and $438.6 million in earnings by 2028. This outlook implies a revenue growth rate of 3.9% annually and an earnings increase of $198.2 million from current earnings of $240.4 million.

Uncover how Element Solutions' forecasts yield a $29.70 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community range between US$22.47 and US$43.80 per share. While many see electronics as the main earnings generator, some highlight the ongoing risk of cyclical downturns that could pressure future results; explore these viewpoints to see how others weigh the opportunity and the risk.

Explore 3 other fair value estimates on Element Solutions - why the stock might be worth 12% less than the current price!

Build Your Own Element Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Element Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Element Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Element Solutions' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.