Please use a PC Browser to access Register-Tadawul

Ford (F): Evaluating Valuation After Q3 Earnings Beat and Strategic F-150 Production Expansion

Ford Motor Company F | 14.09 14.09 | -2.22% 0.00% Pre |

Ford Motor (NYSE:F) shares got a boost after the company delivered better than expected third-quarter earnings, even as it faced disruption from a fire at a major aluminum supplier. Investors are particularly watching Ford’s decision to expand production volumes of its profitable gas and hybrid F-150 and Super Duty trucks.

The upbeat earnings and the plan to ramp up F-Series truck production helped spark a significant turnaround in sentiment around Ford Motor. After a shaky start to the year, the stock has found its stride, boasting a 36% year-to-date share price return and gaining over 20% in the past three months alone. That momentum reflects renewed optimism for Ford’s core business despite persistent supply chain and regulatory headwinds. Its five-year total shareholder return is now above 117%.

If Ford’s strong rebound has you curious about other opportunities in the sector, it is a perfect time to see what’s happening across the industry with the latest See the full list for free.

But with shares up sharply and analysts revising targets, is Ford’s current price a bargain given all the positive headlines, or has the market already factored in all of its future growth prospects?

Most Popular Narrative: 14.7% Overvalued

Ford’s last close at $13.13 sits notably above the most widely followed narrative's fair value estimate of $11.45, indicating that the market is pricing in more optimism than analysts' forecasts support. As the debate intensifies over Ford’s prospects, the following perspective is at the heart of current valuation assumptions.

Ford's ongoing transformation of its Ford Pro commercial platform, with a focus on high-margin, recurring revenues from software, telematics, and aftermarket services, continues to outperform. Paid software subscriptions are up 24% year-over-year and aftermarket is approaching 20% of Pro EBIT. This shift toward recurring digital revenues supports structurally higher net margins and enhances earnings durability.

Want a peek under the hood? The story behind this price centers on bold profitability targets, digital recurring revenues, and a major margin rethink. Curious how this narrative expects Ford to outperform? Dive in to see which financial levers are pulling up or holding back analyst expectations.

Result: Fair Value of $11.45 (OVERVALUED)

However, persistent tariff headwinds or delays in Ford’s electric vehicle strategy could quickly challenge the current positive outlook for future earnings.

Another View: Multiples Say Ford Is a Bargain

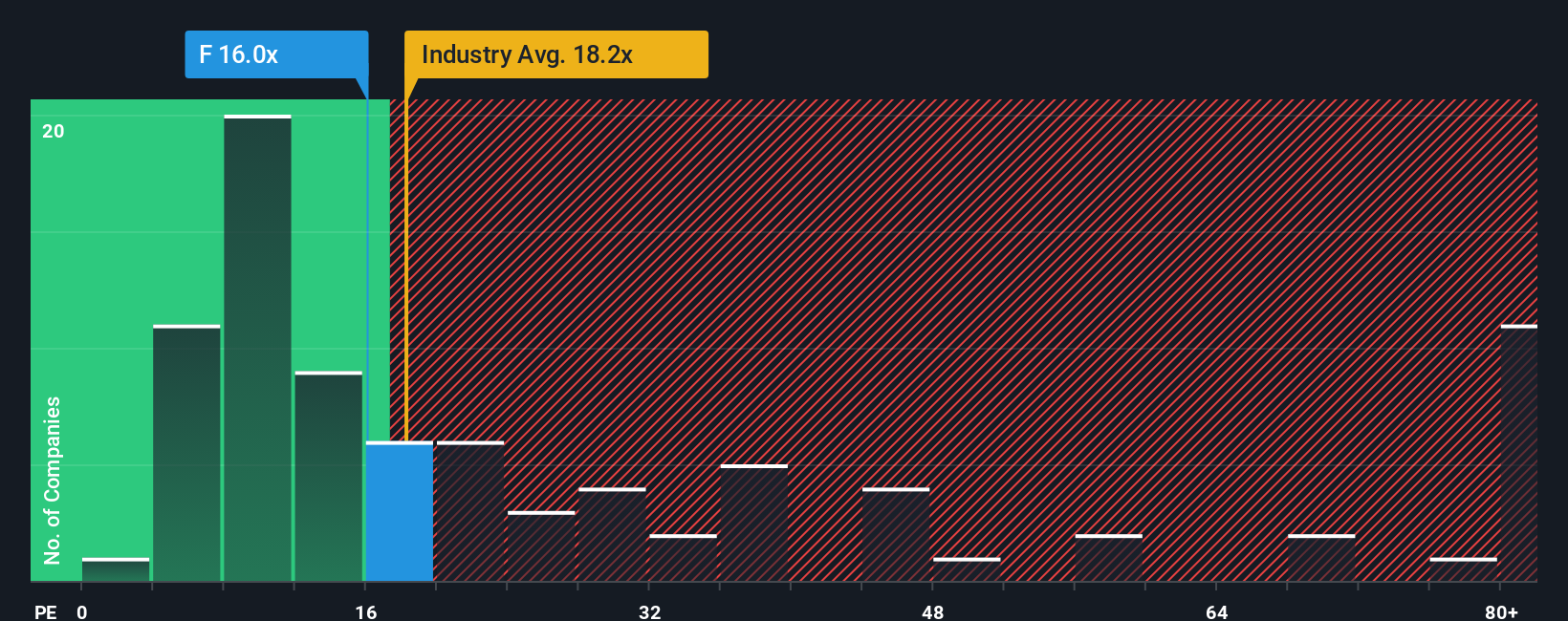

Switching gears from fair value estimates to a basic price-to-earnings approach, Ford currently trades at just 11.1x earnings. That is not only below its global auto industry peers (18.9x) and direct competitors (24.9x), but also well under the fair ratio for the sector at 17.1x. The discount suggests that the market is pricing in more risk or less upside than competitors. But with numbers like these, is Ford being undervalued, or are there real challenges ahead that justify the gap?

Build Your Own Ford Motor Narrative

Not convinced by the numbers or want to dig deeper? Building your own perspective on Ford based on the latest fundamentals takes just a few minutes, so why not Do it your way

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ready to unlock even more investing opportunities? Expand your watchlist now to position yourself for the next breakout. These unique ideas could set you apart from the crowd.

- Power up your income strategy and start generating extra returns by reviewing these 21 dividend stocks with yields > 3% with attractive yields above 3%.

- Capitalize on cutting-edge medicine and AI breakthroughs by checking out these 34 healthcare AI stocks shaking up the future of healthcare.

- Ride the next digital revolution and get ahead of market trends through these 81 cryptocurrency and blockchain stocks, a gateway to blockchain innovators and cryptocurrency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.