Please use a PC Browser to access Register-Tadawul

It's Unlikely That Vector Group Ltd.'s (NYSE:VGR) CEO Will See A Huge Pay Rise This Year

Vector Group Ltd. VGR |

|

Key Insights

- Vector Group will host its Annual General Meeting on 20th of August

- Salary of US$2.02m is part of CEO Howard Lorber's total remuneration

- The overall pay is 1,106% above the industry average

- Over the past three years, Vector Group's EPS grew by 0.3% and over the past three years, the total shareholder return was 61%

CEO Howard Lorber has done a decent job of delivering relatively good performance at Vector Group Ltd. (NYSE:VGR) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 20th of August. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Comparing Vector Group Ltd.'s CEO Compensation With The Industry

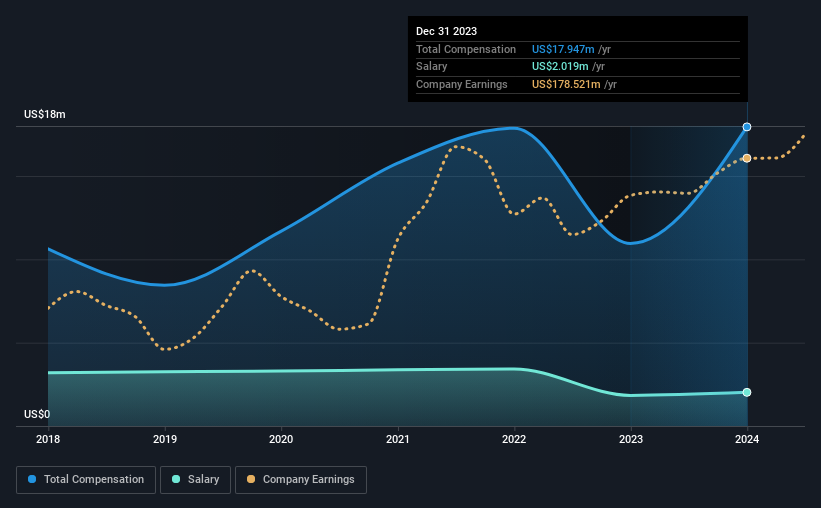

At the time of writing, our data shows that Vector Group Ltd. has a market capitalization of US$2.1b, and reported total annual CEO compensation of US$18m for the year to December 2023. We note that's an increase of 64% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$2.0m.

On examining similar-sized companies in the the US Tobacco industry with market capitalizations between US$1.0b and US$3.2b, we discovered that the median CEO total compensation of that group was US$1.5m. Accordingly, our analysis reveals that Vector Group Ltd. pays Howard Lorber north of the industry median. What's more, Howard Lorber holds US$90m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$2.0m | US$1.8m | 11% |

| Other | US$16m | US$9.1m | 89% |

| Total Compensation | US$18m | US$11m | 100% |

On an industry level, around 33% of total compensation represents salary and 67% is other remuneration. Vector Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Vector Group Ltd.'s Growth

Over the last three years, Vector Group Ltd. has not seen its earnings per share change much, though there is a slight positive movement. It achieved revenue growth of 2.4% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Vector Group Ltd. Been A Good Investment?

Boasting a total shareholder return of 61% over three years, Vector Group Ltd. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 2 which are concerning) in Vector Group we think you should know about.

Arguably, business quality is much more important than CEO compensation levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.